Question: 6. (20 points) True or False: Label each statement as True or False. IF FALSE, briefly explain why. a. When an asset price is high

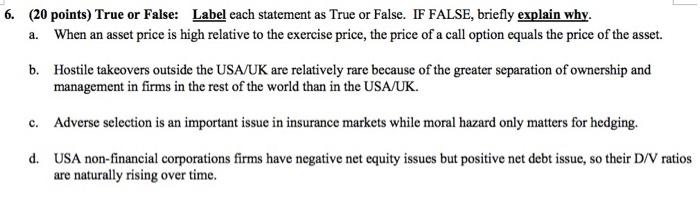

6. (20 points) True or False: Label each statement as True or False. IF FALSE, briefly explain why. a. When an asset price is high relative to the exercise price, the price of a call option equals the price of the asset. b. Hostile takeovers outside the USA/UK are relatively rare because of the greater separation of ownership and management in firms in the rest of the world than in the USA/UK. c. Adverse selection is an important issue in insurance markets while moral hazard only matters for hedging. d. USA non-financial corporations firms have negative net equity issues but positive net debt issue, so their D/V ratios are naturally rising over time. 6. (20 points) True or False: Label each statement as True or False. IF FALSE, briefly explain why. a. When an asset price is high relative to the exercise price, the price of a call option equals the price of the asset. b. Hostile takeovers outside the USA/UK are relatively rare because of the greater separation of ownership and management in firms in the rest of the world than in the USA/UK. c. Adverse selection is an important issue in insurance markets while moral hazard only matters for hedging. d. USA non-financial corporations firms have negative net equity issues but positive net debt issue, so their D/V ratios are naturally rising over time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts