Question: 9. (2 points) A firm has 10 million shares outstanding. It's current share price is $125. For the fiscal year, it reported earnings of S60

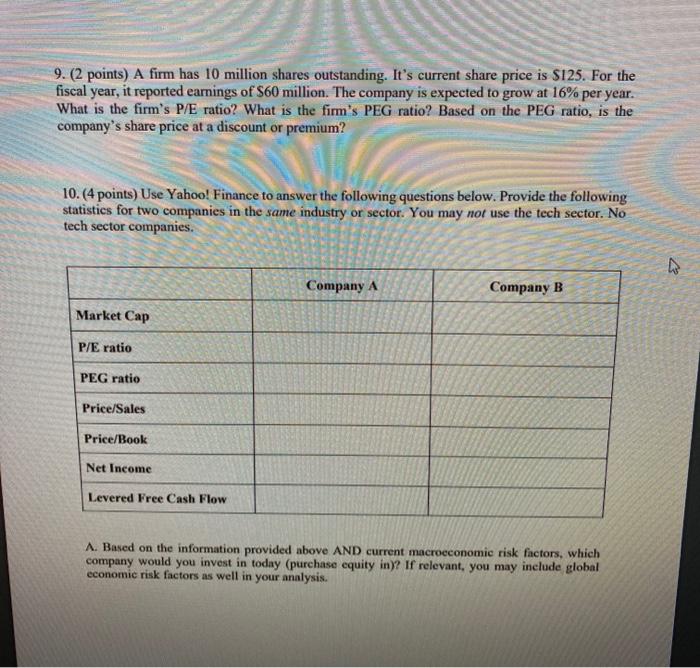

9. (2 points) A firm has 10 million shares outstanding. It's current share price is $125. For the fiscal year, it reported earnings of S60 million. The company is expected to grow at 16% per year. What is the firm's P/E ratio? What is the firm's PEG ratio? Based on the PEG ratio, is the company's share price at a discount or premium? 10.(4 points) Use Yahoo! Finance to answer the following questions below. Provide the following statistics for two companies in the same industry or sector. You may not use the tech sector. No tech sector companies. Company A Company B Market Cap P/E ratio PEG ratio Price/Sales Price/Book Net Income Levered Free Cash Flow A. Based on the information provided above AND current macroeconomic risk factors, which company would you invest in today (purchase equity in)? If relevant, you may include global economic risk factors as well in your analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts