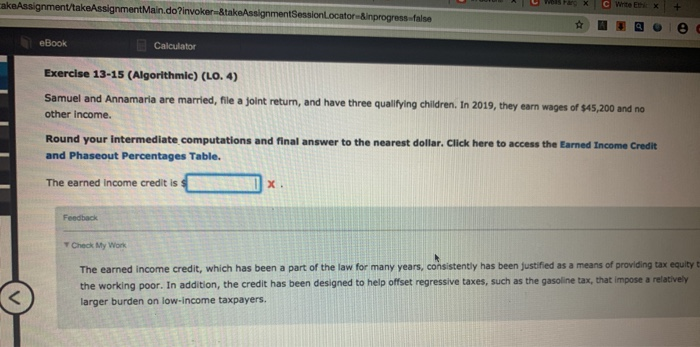

Question: A cakeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator &inprogress-falsa wes Farc Write the eBook Calculator Exercise 13-15 (Algorithmic) (LO. 4) Samuel and Annamaria are married, file a joint retum, and

A cakeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator &inprogress-falsa wes Farc Write the eBook Calculator Exercise 13-15 (Algorithmic) (LO. 4) Samuel and Annamaria are married, file a joint retum, and have three qualifying children. In 2019, they earn wages of $45,200 and no other income. Round your intermediate computations and final answer to the nearest dollar. Click here to access the Earned Income Credit and Phaseout Percentages Table. The earned Income credit is $ Feedback Check My Work The earned Income credit, which has been a part of the law for many years, consistently has been justified as a means of providing tax equity the working poor. In addition, the credit has been designed to help offset regressive taxes, such as the gasoline tax, that impose a relatively larger burden on low-income taxpayers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts