Question: Advanced Scenario 5: Archie Hamilton Interview Notes Archie Hamilton is 45 years old and single Archie had wage income of $55,000. He an He also

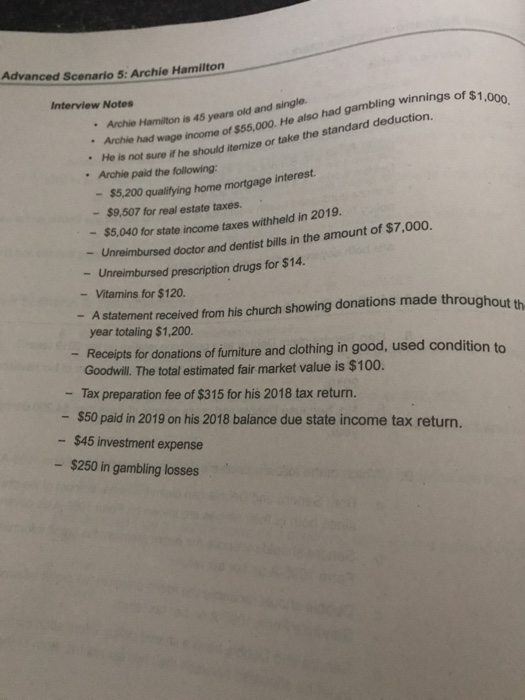

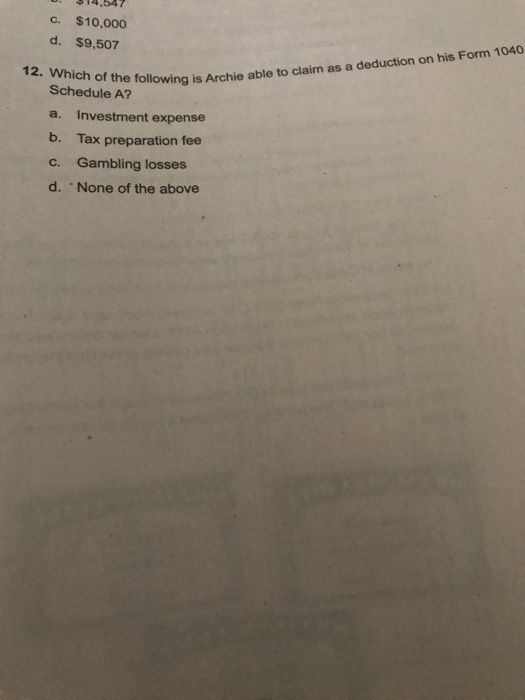

Advanced Scenario 5: Archie Hamilton Interview Notes Archie Hamilton is 45 years old and single Archie had wage income of $55,000. He an He also had gambling winnings of $1.00 not sure if he should itemize or take the standard deduction. He is not sure if he should . Archie paid the following: - $5,200 qualifying home mortgage interest. - $9,507 for real estate taxes. - $5,040 for state income taxes withheld in 2019. Unreimbursed doctor and dentist bills in the amount of $7,000. - Unreimbursed prescription drugs for $14. - Vitamins for $120. - A statement received from his church showing donations made throughout the year totaling $1,200. - Receipts for donations of furniture and clothing in good, used condition to Goodwill. The total estimated fair market value is $100. - Tax preparation fee of $315 for his 2018 tax return. - $50 paid in 2019 on his 2018 balance due state income tax return. - $45 investment expense - $250 in gambling losses 0. 14,547 C. $10,000 d. $9,507 is Archie able to claim as a deduction on his Form 1040 12. Which of the following is Schedule A? a. Investment expense b. Tax preparation fee c. Gambling losses d. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts