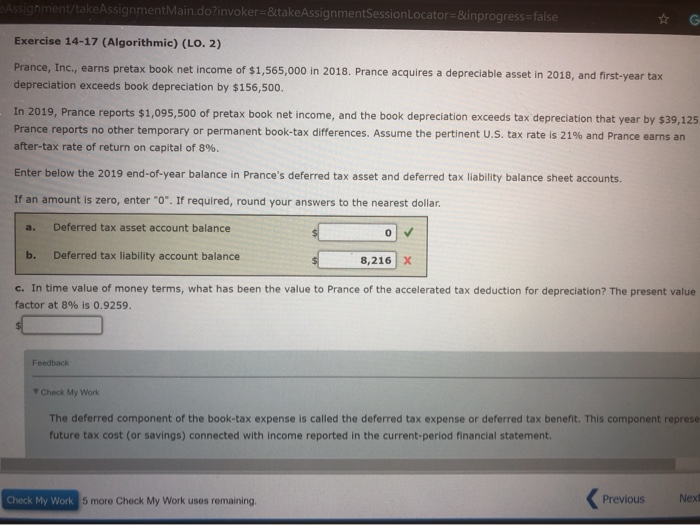

Question: Assignment/takeAssignment Main.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Exercise 14-17 (Algorithmic) (LO. 2) Prance, Inc., earns pretax book net income of $1,565,000 in 2018. Prance acquires a depreciable asset in 2018,

Assignment/takeAssignment Main.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Exercise 14-17 (Algorithmic) (LO. 2) Prance, Inc., earns pretax book net income of $1,565,000 in 2018. Prance acquires a depreciable asset in 2018, and first-year tax depreciation exceeds book depreciation by $156,500. In 2019, Prance reports $1,095,500 of pretax book net income, and the book depreciation exceeds tax depreciation that year by $39,125 Prance reports no other temporary or permanent book-tax differences. Assume the pertinent U.S. tax rate is 21% and Prance earns an after-tax rate of return on capital of 8%. Enter below the 2019 end-of-year balance in Prance's deferred tax asset and deferred tax liability balance sheet accounts. If an amount is zero, enter "0". If required, round your answers to the nearest dollar. a. Deferred tax asset account balance O b. Deferred tax liability account balance 8,216 x c. In time value of money terms, what has been the value to Prance of the accelerated tax deduction for depreciation? The present value factor at 8% is 0.9259. Feedback Check My Work The deferred component of the book-tax expense is called the deferred tax expense or deferred tax benefit. This component repre future tax cost (or savings) connected with income reported in the current period financial statement Check My Work 5 more Check My Work uses remaining. Previous Nex

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts