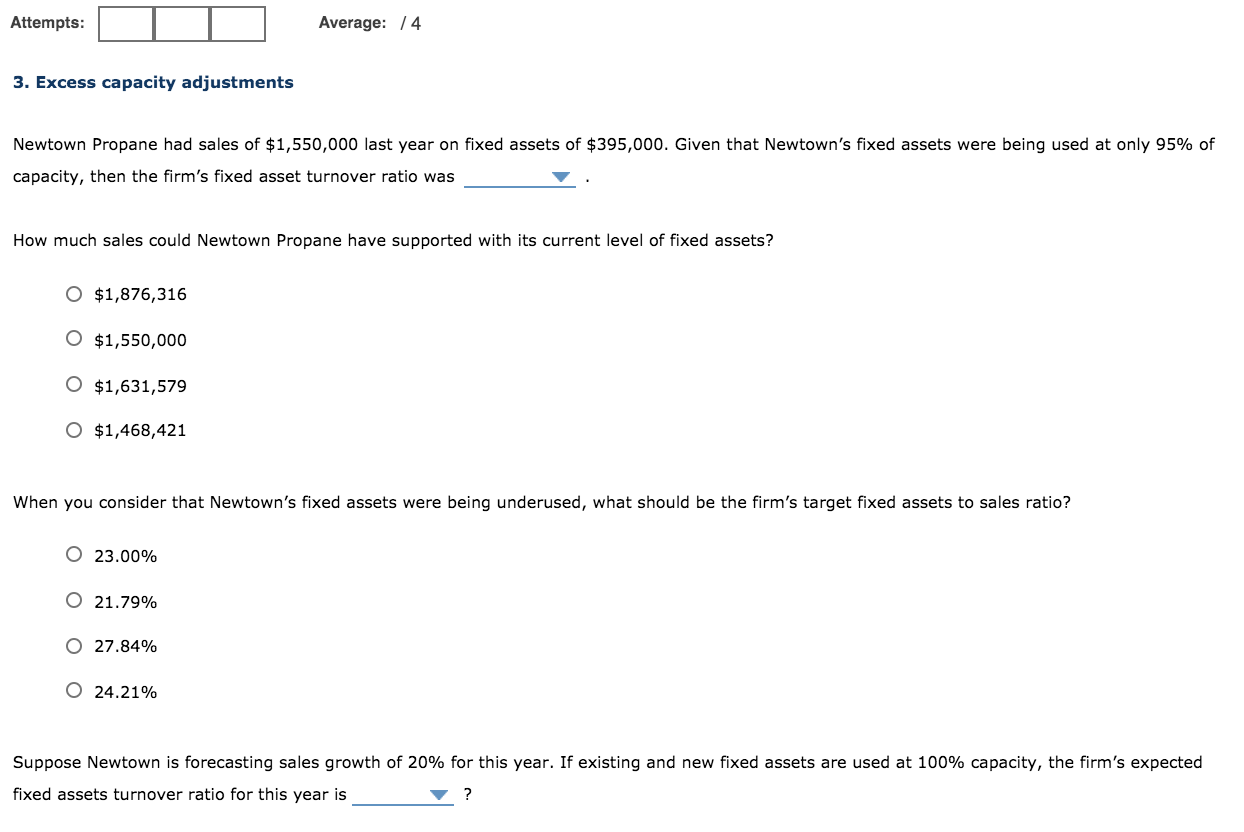

Question: Attempts: Average: 74 3. Excess capacity adjustments Newtown Propane had sales of $1,550,000 last year on fixed assets of $395,000. Given that Newtown's fixed assets

Attempts: Average: 74 3. Excess capacity adjustments Newtown Propane had sales of $1,550,000 last year on fixed assets of $395,000. Given that Newtown's fixed assets were being used at only 95% of capacity, then the firm's fixed asset turnover ratio was How much sales could Newtown Propane have supported with its current level of fixed assets? O $1,876,316 O $1,550,000 $1,631,579 O $1,468,421 When you consider that Newtown's fixed assets were being underused, what should be the firm's target fixed assets to sales ratio? O 23.00% O 21.79% O 27.84% O 24.21% Suppose Newtown is forecasting sales growth of 20% for this year. If existing and new fixed assets are used at 100% capacity, the firm's expected fixed assets turnover ratio for this year is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts