Question: Below is information regarding the capital structure of Micro Advantage Incorporated. On the basis of this information you are asked to respond to the following

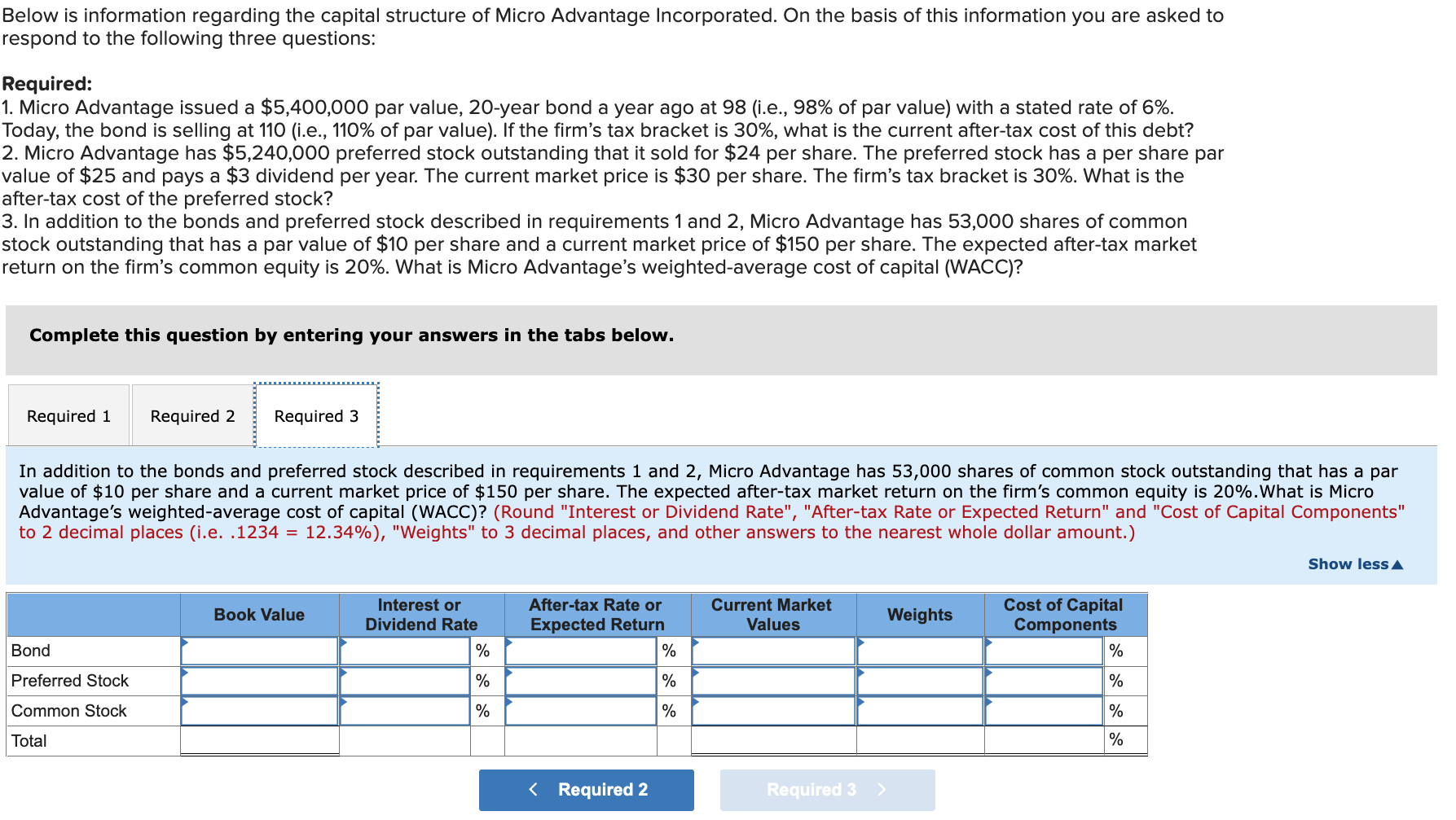

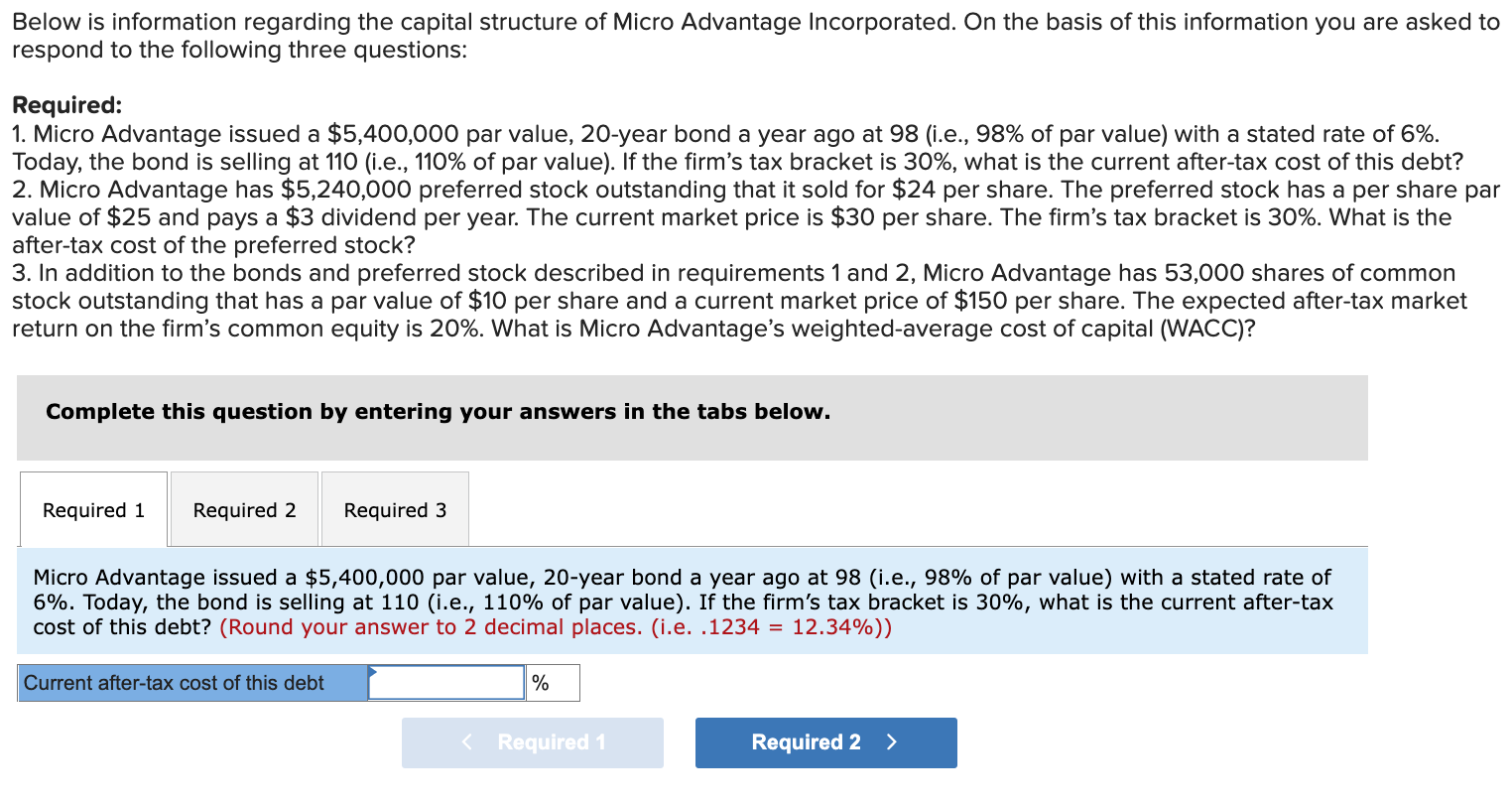

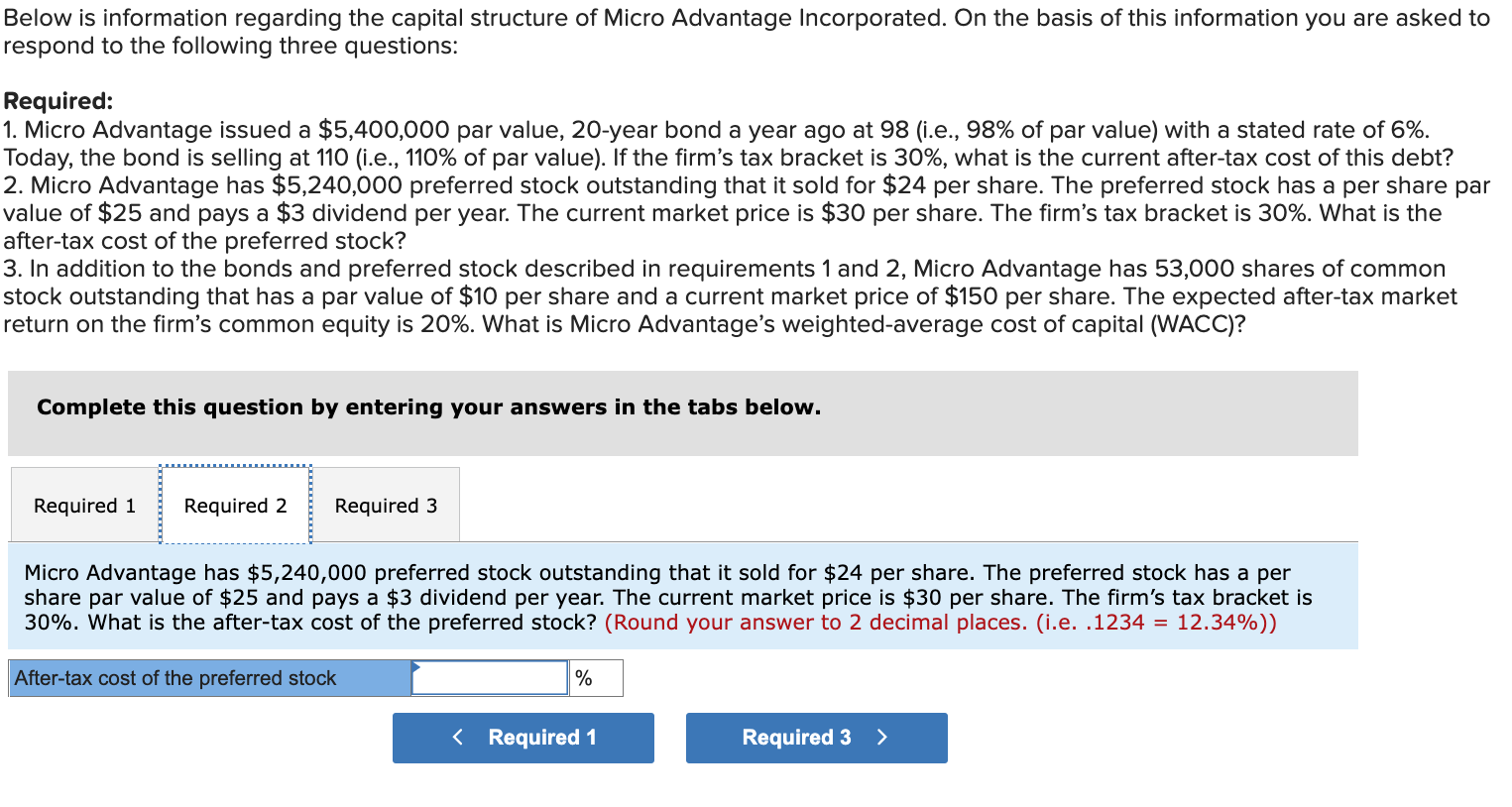

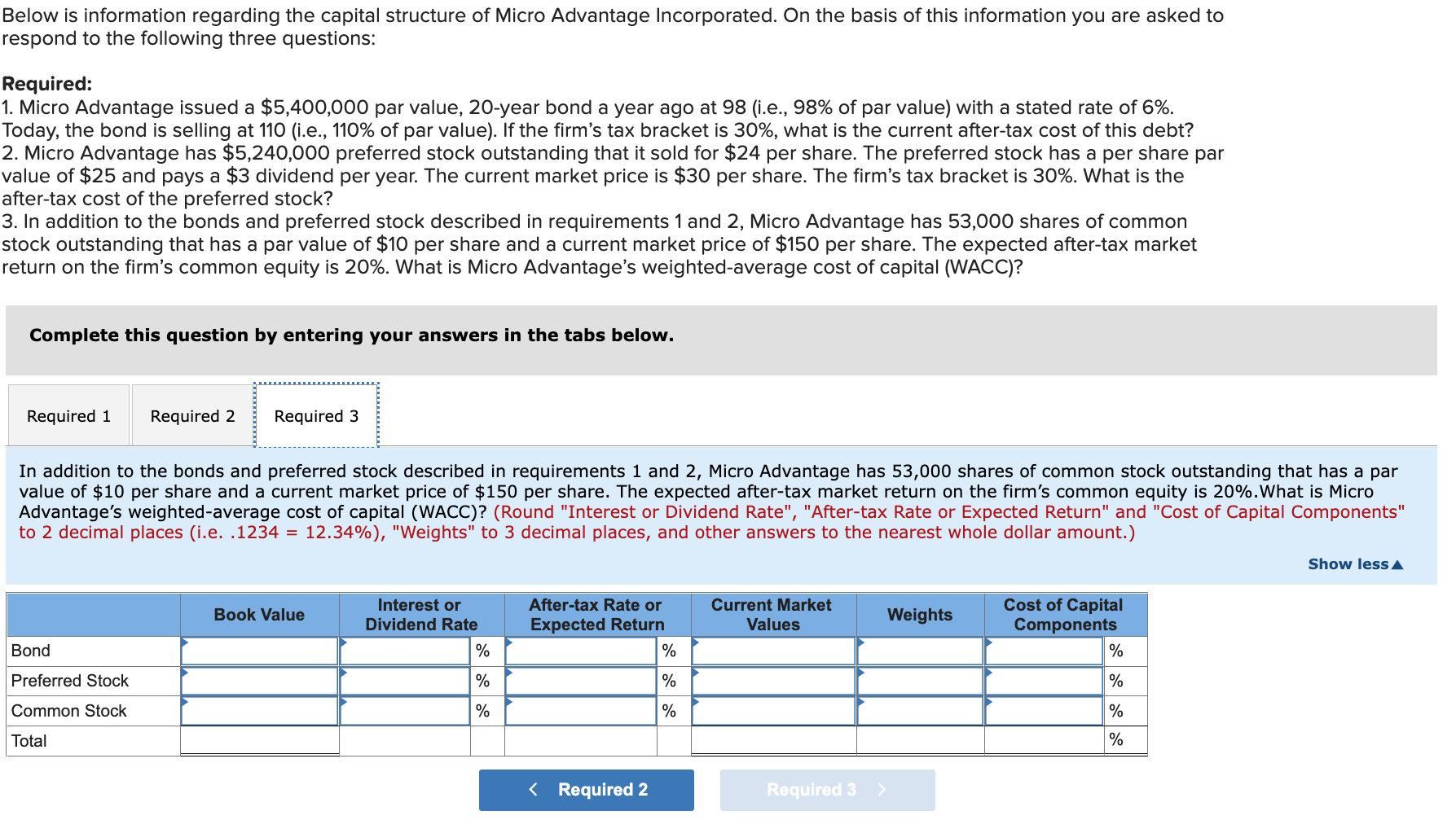

Below is information regarding the capital structure of Micro Advantage Incorporated. On the basis of this information you are asked to respond to the following three questions: Required: 1. Micro Advantage issued a $5,400,000 par value, 20-year bond a year ago at 98 (i.e., 98% of par value) with a stated rate of 6%. Today, the bond is selling at 110 (i.e., 110% of par value). If the firm's tax bracket is 30%, what is the current after-tax cost of this debt? 2. Micro Advantage has $5,240,000 preferred stock outstanding that it sold for $24 per share. The preferred stock has a per share par value of $25 and pays a $3 dividend per year. The current market price is $30 per share. The firm's tax bracket is 30%. What is the after-tax cost of the preferred stock? 3. In addition to the bonds and preferred stock described in requirements 1 and 2, Micro Advantage has 53,000 shares of common stock outstanding that has a par value of $10 per share and a current market price of $150 per share. The expected after-tax market return on the firm's common equity is 20%. What is Micro Advantage's weighted-average cost of capital (WACC)? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Micro Advantage issued a $5,400,000 par value, 20-year bond a year ago at 98 (i.e., 98% of par value) with a stated rate of 6%. Today, the bond is selling at 110 (i.e., 110% of par value). If the firm's tax bracket is 30%, what is the current after-tax cost of this debt? (Round your answer to 2 decimal places. (i.e. .1234 = 12.34%)) Current after-tax cost of this debt % Below is information regarding the capital structure of Micro Advantage Incorporated. On the basis of this information you are asked to respond to the following three questions: Required: 1. Micro Advantage issued a $5,400,000 par value, 20-year bond a year ago at 98 (i.e., 98% of par value) with a stated rate of 6%. Today, the bond is selling at 110 (i.e., 110% of par value). If the firm's tax bracket is 30%, what is the current after-tax cost of this debt? 2. Micro Advantage has $5,240,000 preferred stock outstanding that it sold for $24 per share. The preferred stock has a per share par value of $25 and pays a $3 dividend per year. The current market price is $30 per share. The firm's tax bracket is 30%. What is the after-tax cost of the preferred stock? 3. In addition to the bonds and preferred stock described in requirements 1 and 2, Micro Advantage has 53,000 shares of common stock outstanding that has a par value of $10 per share and a current market price of $150 per share. The expected after-tax market return on the firm's common equity is 20%. What is Micro Advantage's weighted average cost of capital (WACC)? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Micro Advantage has $5,240,000 preferred stock outstanding that it sold for $24 per share. The preferred stock has a per share par value of $25 and pays a $3 dividend per year. The current market price is $30 per share. The firm's tax bracket is 30%. What is the after-tax cost of the preferred stock? (Round your answer to 2 decimal places. (i.e. .1234 = 12.34%)) After-tax cost of the preferred stock % Below is information regarding the capital structure of Micro Advantage Incorporated. On the basis of this information you are asked to respond to the following three questions: Required: 1. Micro Advantage issued a $5,400,000 par value, 20-year bond a year ago at 98 (i.e., 98% of par value) with a stated rate of 6%. Today, the bond is selling at 110 (i.e., 110% of par value). If the firm's tax bracket is 30%, what is the current after-tax cost of this debt? 2. Micro Advantage has $5,240,000 preferred stock outstanding that it sold for $24 per share. The preferred stock has a per share par value of $25 and pays a $3 dividend per year. The current market price is $30 per share. The firm's tax bracket is 30%. What is the after-tax cost of the preferred stock? 3. In addition to the bonds and preferred stock described in requirements 1 and 2, Micro Advantage has 53,000 shares of common stock outstanding that has a par value of $10 per share and a current market price of $150 per share. The expected after-tax market return on the firm's common equity is 20%. What is Micro Advantage's weighted-average cost of capital (WACC)? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 In addition to the bonds and preferred stock described in requirements 1 and 2, Micro Advantage has 53,000 shares of common stock outstanding that has a par value of $10 per share and a current market price of $150 per share. The expected after-tax market return on the firm's common equity is 20%.What is Micro Advantage's weighted average cost of capital (WACC)? (Round "Interest or Dividend Rate", "After-tax Rate or Expected Return" and "Cost of Capital Components" to 2 decimal places (i.e. .1234 = 12.34%), "Weights" to 3 decimal places, and other answers to the nearest whole dollar amount.) Show less A Book Value Interest or Dividend Rate After-tax Rate or Expected Return % Current Market Values Weights Cost of Capital Components % Bond % Preferred Stock % % % Common Stock % % % Total %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts