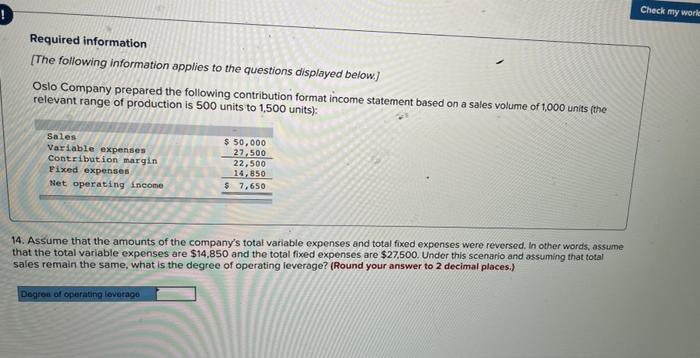

Question: Check my ! Required information [The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on

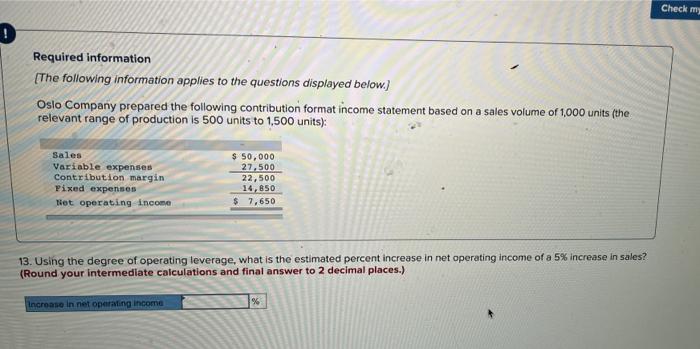

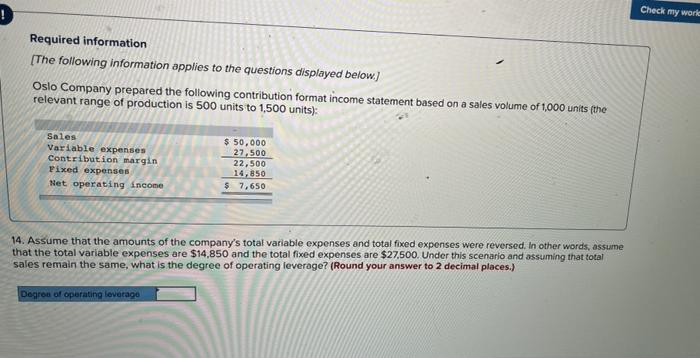

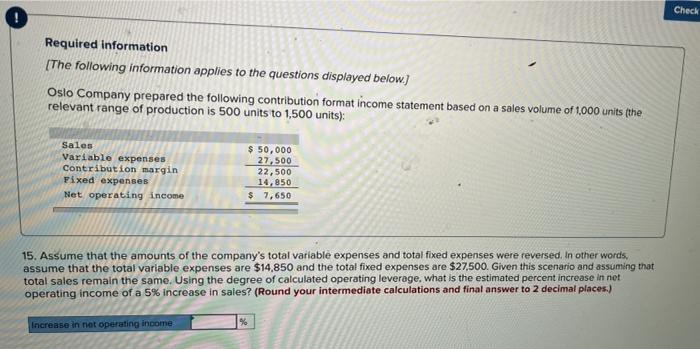

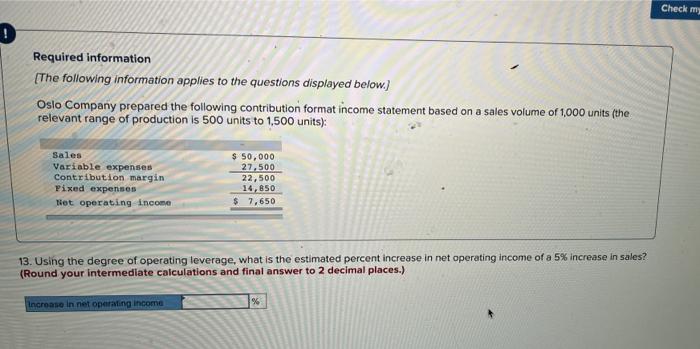

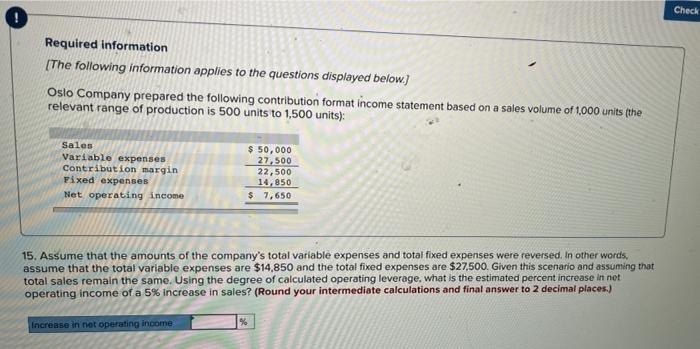

Check my ! Required information [The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Pixed expenses Het operating income $ 50,000 27.500 22,500 14,850 $ 7.650 13. Using the degree of operating leverage, what is the estimated percent increase in net operating income of a 5% increase in sales? (Round your intermediate calculations and final answer to 2 decimal places.) Increase in net operating income ! Check my world Required information (The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1.500 units): Sales Variable expenses Contribution margin Pixed expenses Net operating income $ 50,000 27,500 22,500 14,850 $ 7,650 14. Assume that the amounts of the company's total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $14,850 and the total fixed expenses are $27,500. Under this scenario and assuming that total sales remain the same, what is the degree of operating leverage? (Round your answer to 2 decimal places.) Degree of operating leverago Check Required information (The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units); Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 50,000 27,500 22,500 14,850 $ 7,650 15. Assume that the amounts of the company's total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $14,850 and the total fixed expenses are $27,500. Given this scenario and assuming that total sales remain the same. Using the degree of calculated operating leverage, what is the estimated percent increase in net operating income of a 5% increase in sales? (Round your intermediate calculations and final answer to 2 decimal places.) Increase in not operating income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts