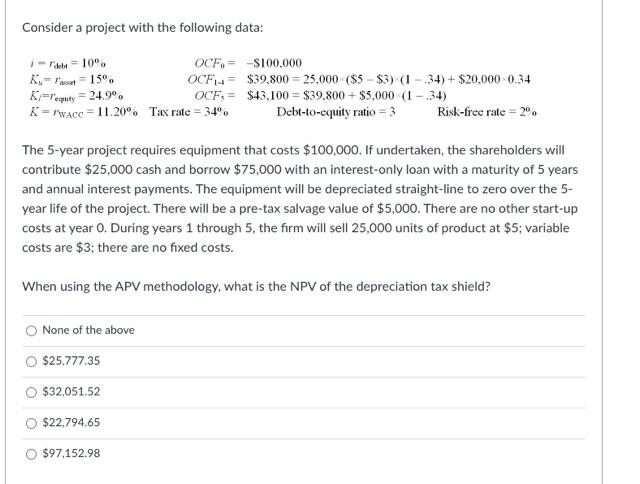

Question: Consider a project with the following data: - Part 10 OCF, = $100,000 = 130 OCF14 = $39.800 = 25.000 ($5 - $3) (1 -

Consider a project with the following data: - Part 10 OCF, = $100,000 = 130 OCF14 = $39.800 = 25.000 ($5 - $3) (1 - 34) + $20.000 0.34 = 24.99 OCFs = $43,100 = $39.800 + $5,000 (1 - 34) Kwacc = 11. 20. Tax rate = 34. Debt-to-equity ratio = 3 Risk-free rate=2" Kaset K-reputy The 5-year project requires equipment that costs $100,000. If undertaken, the shareholders will contribute $25,000 cash and borrow $75,000 with an interest-only loan with a maturity of 5 years and annual interest payments. The equipment will be depreciated straight-line to zero over the 5- year life of the project. There will be a pre-tax salvage value of $5,000. There are no other start-up costs at year 0. During years 1 through 5, the firm will sell 25,000 units of product at $5; variable costs are $3; there are no fixed costs. When using the APV methodology, what is the NPV of the depreciation tax shield? None of the above O $25.777.35 $32.051.52 $22.794.65 $97.152.98

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts