Question: Cookie Creations 4 a-c (Part Level Submission) Natalie had a very busy December. At the end of the month, after journalizing and posting the December

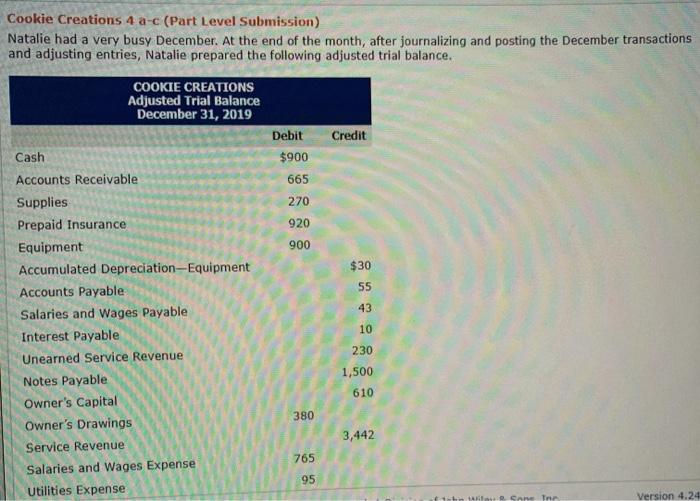

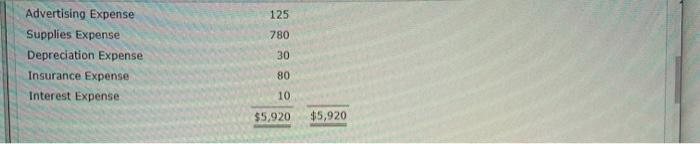

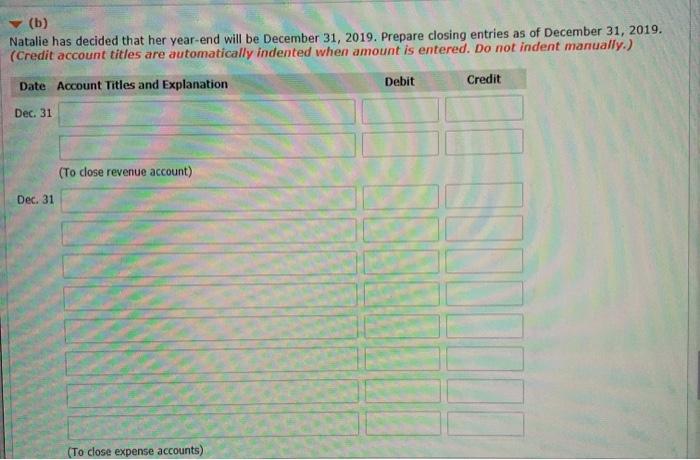

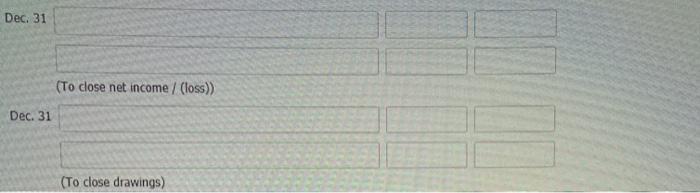

Cookie Creations 4 a-c (Part Level Submission) Natalie had a very busy December. At the end of the month, after journalizing and posting the December transactions and adjusting entries, Natalie prepared the following adjusted trial balance. COOKIE CREATIONS Adjusted Trial Balance December 31, 2019 Credit Debit $900 665 270 920 900 $30 55 43 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation--Equipment Accounts Payable Salaries and Wages Payable Interest Payable Unearned Service Revenue Notes Payable Owner's Capital Owner's Drawings Service Revenue Salaries and Wages Expense Utilities Expense 10 230 1,500 610 380 3,442 765 95 lastne Version 4.24 125 780 Advertising Expense Supplies Expense Depreciation Expense Insurance Expense Interest Expense 30 80 10 $5,920 $5,920 (b) Natalie has decided that her year-end will be December 31, 2019. Prepare closing entries as of December 31, 2019. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 (To close revenue account) Dec. 31 (To close expense accounts) Dec. 31 (To close net income / (loss)) Dec. 31 (To close drawings)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts