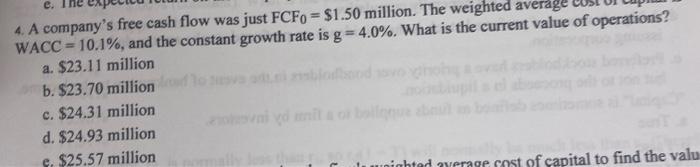

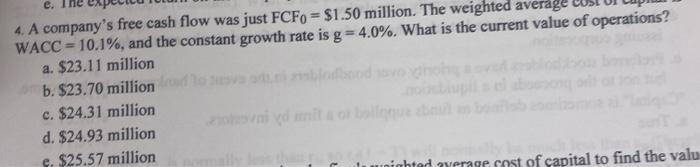

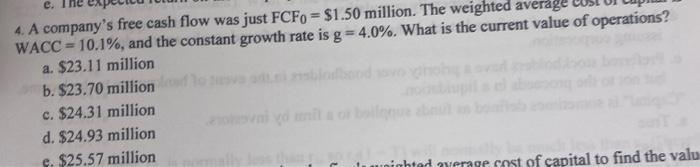

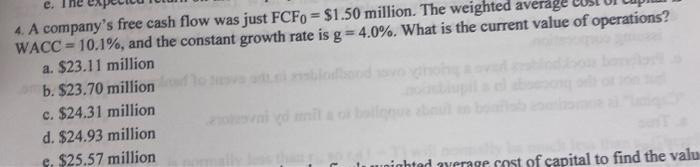

Question: e. 4. A company's free cash flow was just FCF0 = $1.50 million. The weighted average WACC = 10.1%, and the constant growth rate is

e. 4. A company's free cash flow was just FCF0 = $1.50 million. The weighted average WACC = 10.1%, and the constant growth rate is g = 4.0%. What is the current value of operations? a. $23.11 million b. $23.70 million c. $24.31 million d. $24.93 million . $25.57 million nighted werage cost of capital to find the valu e. 4. A company's free cash flow was just FCF0 = $1.50 million. The weighted average WACC = 10.1%, and the constant growth rate is g = 4.0%. What is the current value of operations? a. $23.11 million b. $23.70 million c. $24.31 million d. $24.93 million . $25.57 million nighted werage cost of capital to find the valu

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts