Question: Exercise 1 : We consider a portfolio return, yt such that the conditional distribution of Yeth given yt, yt-1,... is Gaussian : Yt+Alyt ~ N[m(h,

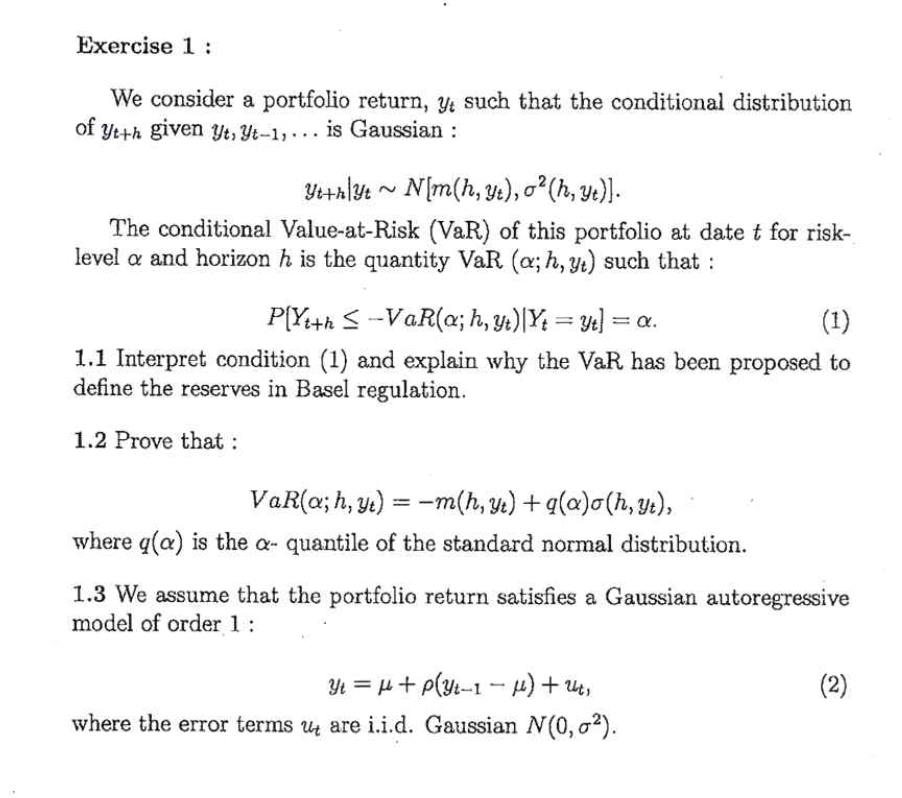

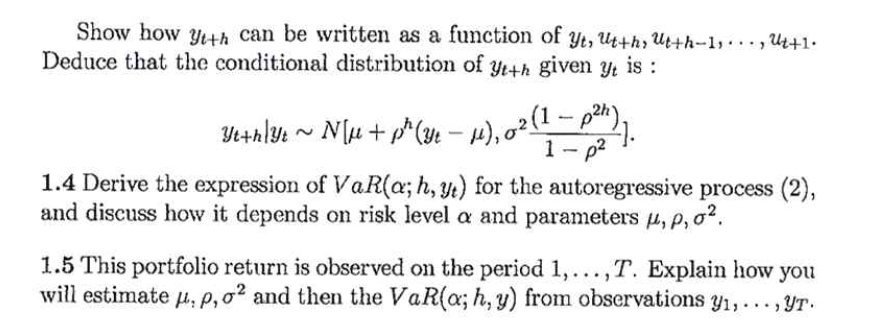

Exercise 1 : We consider a portfolio return, yt such that the conditional distribution of Yeth given yt, yt-1,... is Gaussian : Yt+Alyt ~ N[m(h, Yt), o?(h, ye)]. The conditional Value-at-Risk (VaR) of this portfolio at date t for risk- level a and horizon h is the quantity VaR (a; h, yt) such that : P[Yith 5 --VaR(a; h, y)|Y4 = Y) = a. (1) 1.1 Interpret condition (1) and explain why the VaR has been proposed to define the reserves in Basel regulation. 1.2 Prove that: VaR(a; h, y) = -m(h, yt) +q(Q),(h, yt), where q(a) is the q- quantile of the standard normal distribution. 1.3 We assume that the portfolio return satisfies a Gaussian autoregressive model of order 1: (2) Yu = 4 +p(y-1 - ) + 2t, where the error terms ut are i.i.d. Gaussian N(0,02). Yt+n\yw ~ N(y + p"( M), 02(1 - p2h), Show how yth can be written as a function of yt, Utthy Ut+h-1,..., U1+1. Deduce that the conditional distribution of yt+h given yt is : 1-p2 1.4 Derive the expression of VaR(a; h, yt) for the autoregressive process (2), and discuss how it depends on risk level a and parameters H, P, 02. 1.5 This portfolio return is observed on the period 1,...,T. Explain how you will estimate Hip, o2 and then the VaR(a; h, y) from observations yi, ..., YT Exercise 1 : We consider a portfolio return, yt such that the conditional distribution of Yeth given yt, yt-1,... is Gaussian : Yt+Alyt ~ N[m(h, Yt), o?(h, ye)]. The conditional Value-at-Risk (VaR) of this portfolio at date t for risk- level a and horizon h is the quantity VaR (a; h, yt) such that : P[Yith 5 --VaR(a; h, y)|Y4 = Y) = a. (1) 1.1 Interpret condition (1) and explain why the VaR has been proposed to define the reserves in Basel regulation. 1.2 Prove that: VaR(a; h, y) = -m(h, yt) +q(Q),(h, yt), where q(a) is the q- quantile of the standard normal distribution. 1.3 We assume that the portfolio return satisfies a Gaussian autoregressive model of order 1: (2) Yu = 4 +p(y-1 - ) + 2t, where the error terms ut are i.i.d. Gaussian N(0,02). Yt+n\yw ~ N(y + p"( M), 02(1 - p2h), Show how yth can be written as a function of yt, Utthy Ut+h-1,..., U1+1. Deduce that the conditional distribution of yt+h given yt is : 1-p2 1.4 Derive the expression of VaR(a; h, yt) for the autoregressive process (2), and discuss how it depends on risk level a and parameters H, P, 02. 1.5 This portfolio return is observed on the period 1,...,T. Explain how you will estimate Hip, o2 and then the VaR(a; h, y) from observations yi, ..., YT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts