Question: Exercise 3 Snowbird Company is constructing a building that qualifies for interest capitalization. It is built be true 1, January 1 and December 31, 2020.

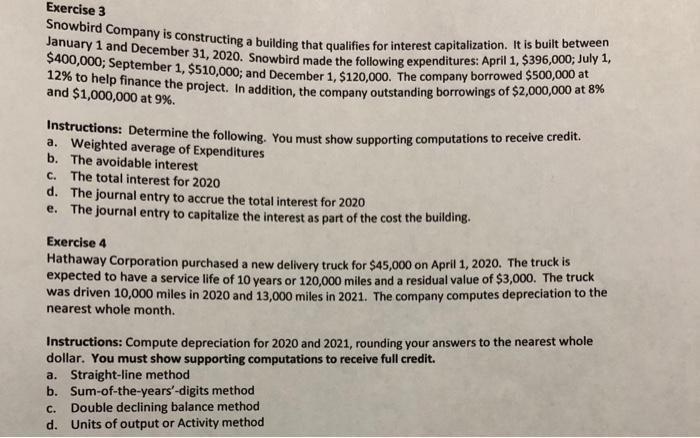

Exercise 3 Snowbird Company is constructing a building that qualifies for interest capitalization. It is built be true 1, January 1 and December 31, 2020. Snowbird made the following expenditures: April 1, $396,000; July 1, 12% to help finance the project. In addition, the company outstanding borrowings of $2,000,000 at 8% and $1,000,000 at 9%. Instructions: Determine the following. You must show supporting computations to receive credit. a. Weighted average of Expenditures b. The avoidable interest c. The total interest for 2020 d. The journal entry to accrue the total interest for 2020 e. The journal entry to capitalize the interest as part of the cost the building. Exercise 4 Hathaway Corporation purchased a new delivery truck for $45,000 on April 1, 2020. The truck is expected to have a service life of 10 years or 120,000 miles and a residual value of $3,000. The truck was driven 10,000 miles in 2020 and 13,000 miles in 2021. The company computes depreciation to the nearest whole month. Instructions: Compute depreciation for 2020 and 2021, rounding your answers to the nearest whole dollar. You must show supporting computations to receive full credit. a. Straight-line method b. Sum-of-the-years'-digits method Double declining balance method d. Units of output or Activity method C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts