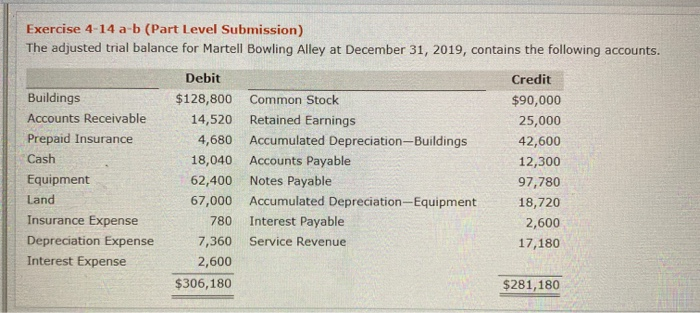

Question: Exercise 4-14 a-b (Part Level Submission) The adjusted trial balance for Martell Bowling Alley at December 31, 2019, contains the following accounts. Buildings Accounts Receivable

Exercise 4-14 a-b (Part Level Submission) The adjusted trial balance for Martell Bowling Alley at December 31, 2019, contains the following accounts. Buildings Accounts Receivable Prepaid Insurance Cash Equipment Land Insurance Expense Depreciation Expense Interest Expense Debit $128,800 14,520 4,680 18,040 62,400 67,000 780 7,360 2,600 $306,180 Common Stock Retained Earnings Accumulated Depreciation-Buildings Accounts Payable Notes Payable Accumulated Depreciation-Equipment Interest Payable Service Revenue Credit $90,000 25,000 42,600 12,300 97,780 18,720 2,600 17,180 $281,180 Prepare a classified balance sheet; assume that $22,000 of the note payable will be paid in 2020. (List Property, plant and equipment in order of land, buildings and equipment List Current Assets in order of liquidity.) Martell Bowling Alley Balance Sheet Liabilities and Stockholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts