Question: II. Please try to analyze the following cases and write down the appropriate recoding process.. Payne Company purchased equipment in 2010 for $90,000 and

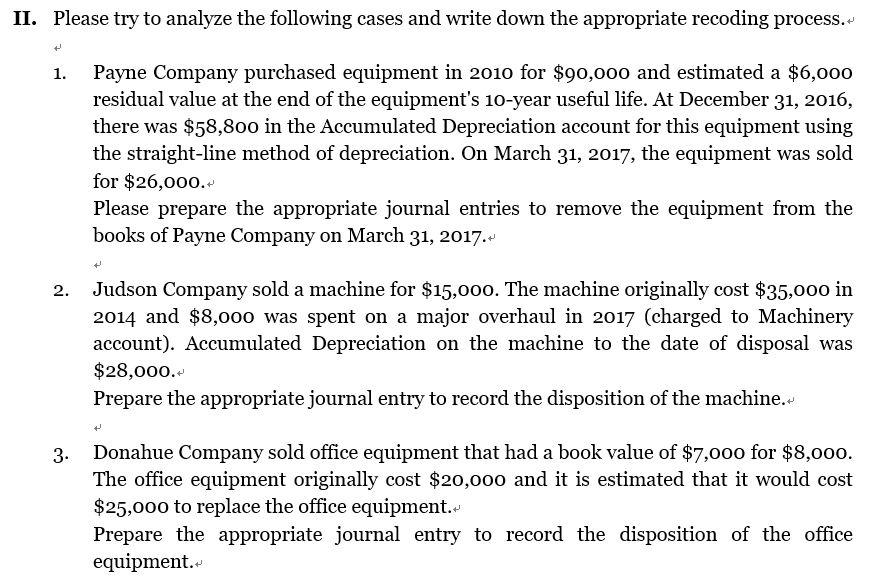

II. Please try to analyze the following cases and write down the appropriate recoding process.. Payne Company purchased equipment in 2010 for $90,000 and estimated a $6,000 residual value at the end of the equipment's 10-year useful life. At December 31, 2016, there was $58,800 in the Accumulated Depreciation account for this equipment using the straight-line method of depreciation. On March 31, 2017, the equipment was sold for $26,000.- 1. Please prepare the appropriate journal entries to remove the equipment from the books of Payne Company on March 31, 2017. 2. Judson Company sold a machine for $15,00o. The machine originally cost $35,000 in 2014 and $8,000 was spent on a major overhaul in 2017 (charged to Machinery account). Accumulated Depreciation on the machine to the date of disposal was $28,000. Prepare the appropriate journal entry to record the disposition of the machine. Donahue Company sold office equipment that had a book value of $7,000 for $8,000. The office equipment originally cost $20,000 and it is estimated that it would cost $25,000 to replace the office equipment.. Prepare the appropriate journal entry to record the disposition of the office equipment. 3.

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Journal entries Date Particulars Debit Credit 1 Cash ac Dr 26000 Accumulated depreciation Dr ... View full answer

Get step-by-step solutions from verified subject matter experts