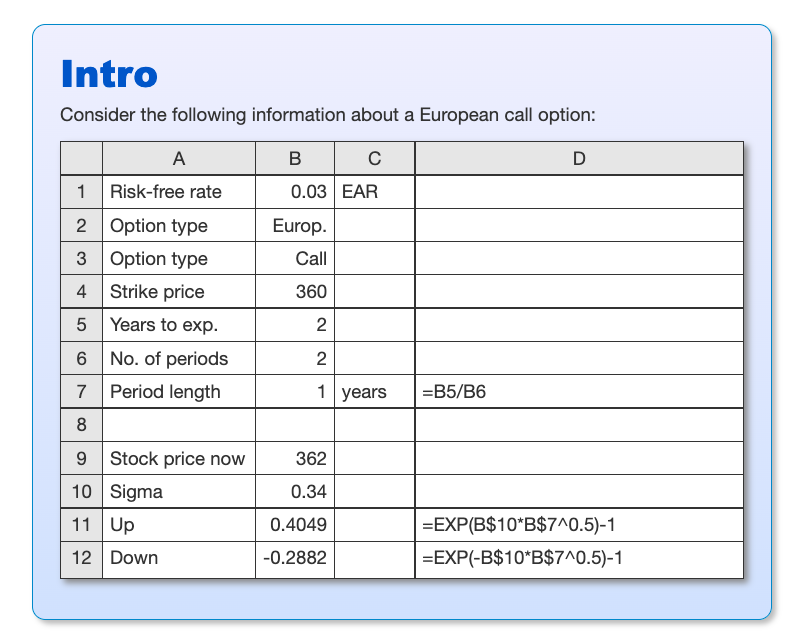

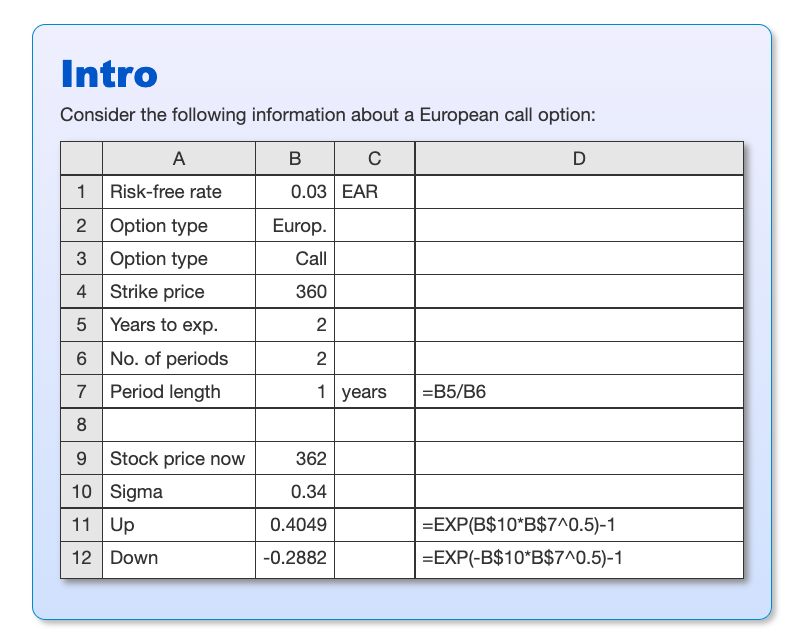

Question: Intro Consider the following information about a European call option: B ? D 0.03 EAR Europ. Call A 1 Risk-free rate 2 Option type 3

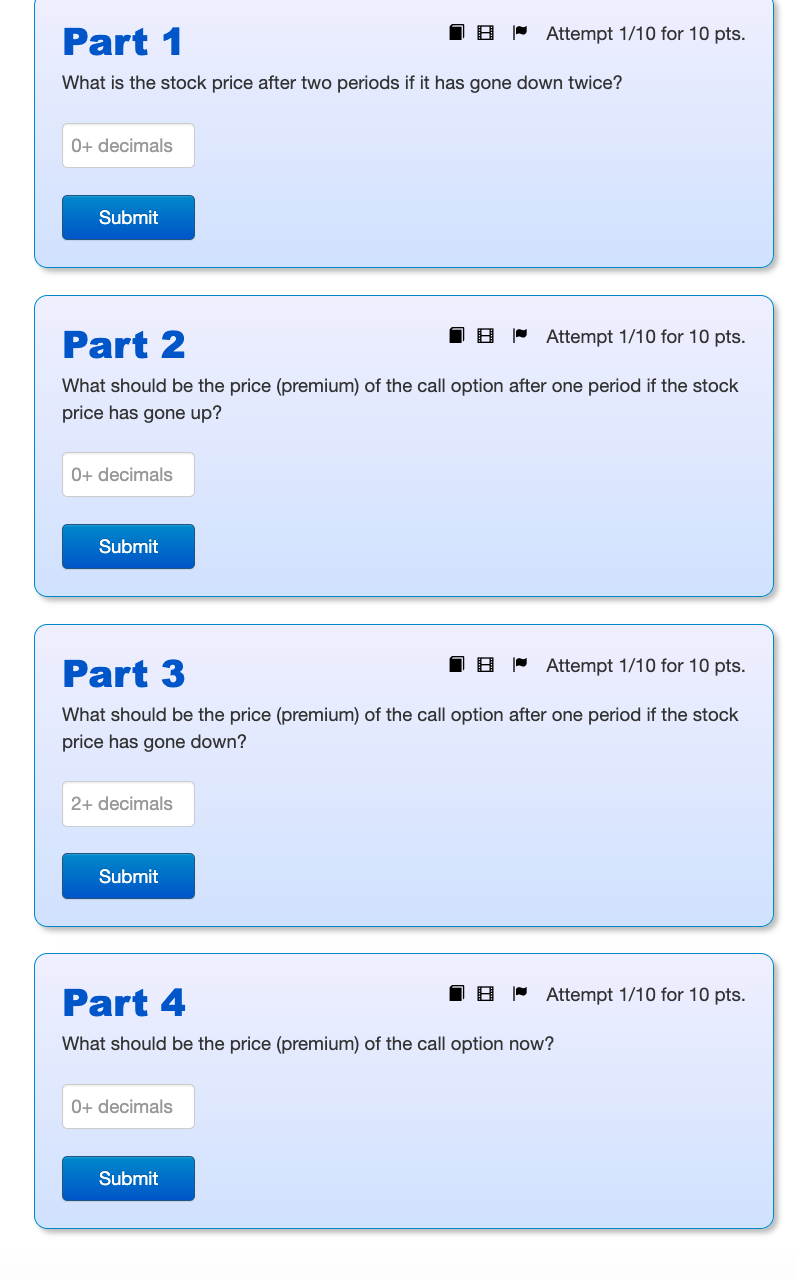

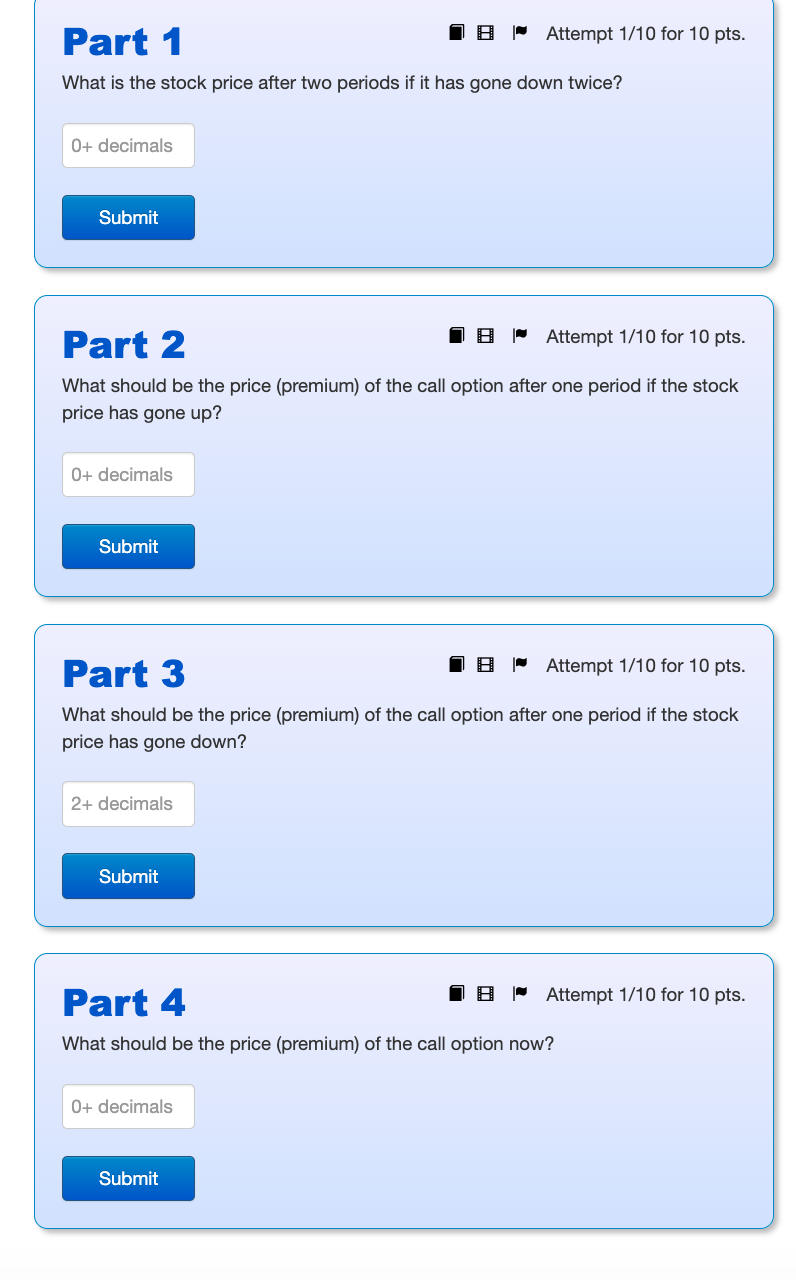

Intro Consider the following information about a European call option: B ? D 0.03 EAR Europ. Call A 1 Risk-free rate 2 Option type 3 Option type 4 Strike price 5 Years to exp. 6 No. of periods 7 Period length 360 2 2 1 years =B5/B6 8 362 9 Stock price now 10 Sigma 11 Up 0.34 0.4049 =EXP(B$10*B$7^0.5)-1 =EXP(-B$10*B$7^0.5)-1 12 Down -0.2882 Part 1 8 | Attempt 1/10 for 10 pts. What is the stock price after two periods if it has gone down twice? 0+ decimals Submit IB Attempt 1/10 for 10 pts. Part 2 What should be the price (premium) of the call option after one period if the stock price has gone up? 0+ decimals Submit Part 3 B Attempt 1/10 for 10 pts. What should be the price (premium) of the call option after one period if the stock price has gone down? 2+ decimals Submit Part 4 8 Attempt 1/10 for 10 pts. What should be the price (premium) of the call option now? 0+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts