Question: Key Assignment 1 Sean died on January 1, 2021 in a car accident. The property that he owned at the time of his death included

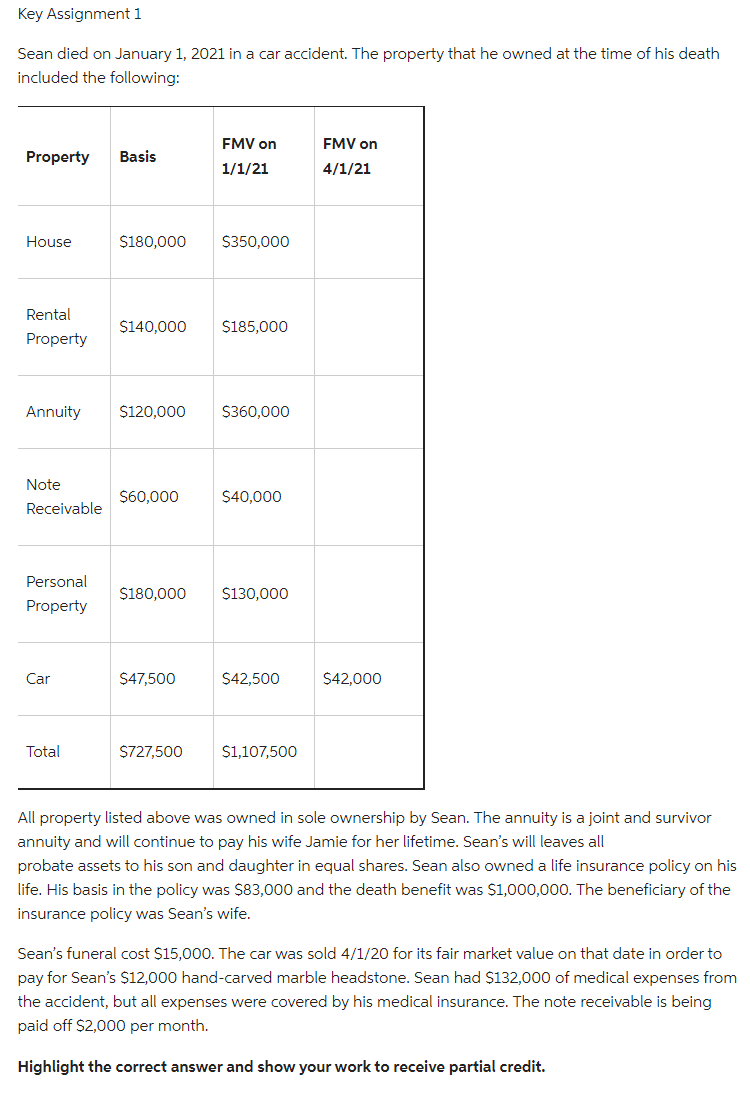

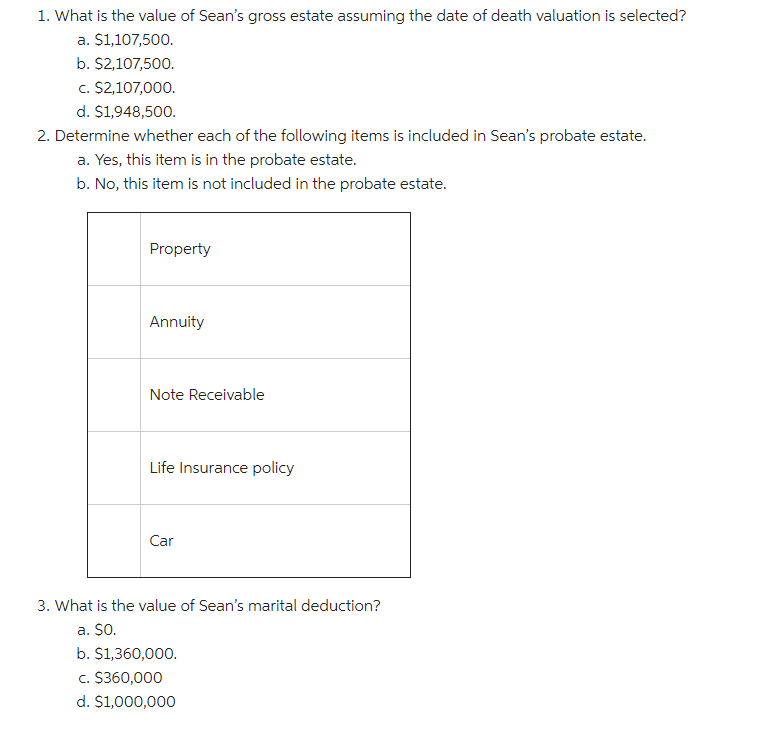

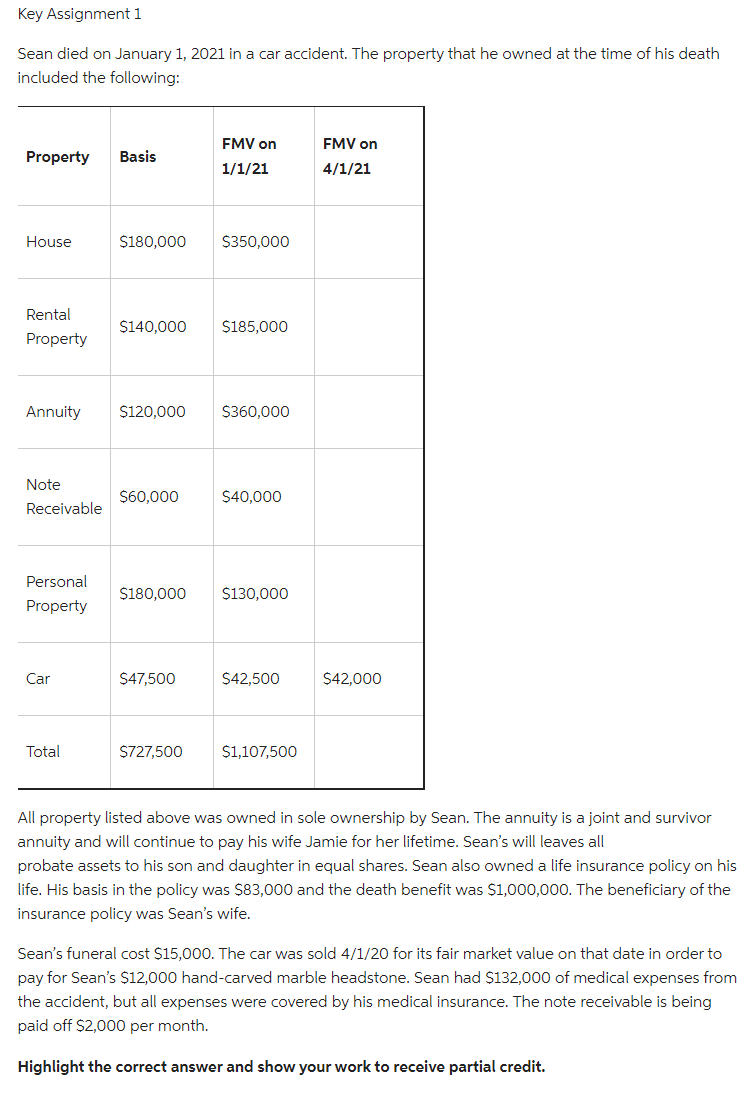

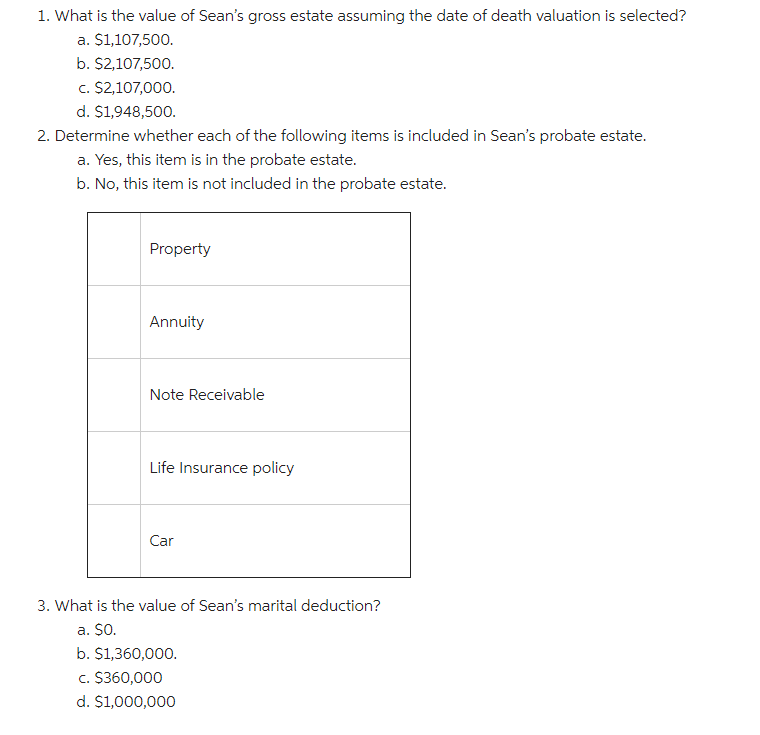

Key Assignment 1 Sean died on January 1, 2021 in a car accident. The property that he owned at the time of his death included the following: All property listed above was owned in sole ownership by Sean. The annuity is a joint and survivor annuity and will continue to pay his wife Jamie for her lifetime. Sean's will leaves all probate assets to his son and daughter in equal shares. Sean also owned a life insurance policy on his life. His basis in the policy was $83,000 and the death benefit was $1,000,000. The beneficiary of the insurance policy was Sean's wife. Sean's funeral cost $15,000. The car was sold 4/1/20 for its fair market value on that date in order to pay for Sean's $12,000 hand-carved marble headstone. Sean had $132,000 of medical expenses from the accident, but all expenses were covered by his medical insurance. The note receivable is being paid off $2,000 per month. Highlight the correct answer and show your work to receive partial credit. 1. What is the value of Sean's gross estate assuming the date of death valuation is selected? a. $1,107,500. b. $2,107,500. c. $2,107,000. d. $1,948,500. 2. Determine whether each of the following items is included in Sean's probate estate. a. Yes, this item is in the probate estate. b. No, this item is not included in the probate estate. 3. What is the value of Sean's marital deduction? a. $0. b. $1,360,000. c. $360,000 d. $1,000,000 Key Assignment 1 Sean died on January 1, 2021 in a car accident. The property that he owned at the time of his death included the following: All property listed above was owned in sole ownership by Sean. The annuity is a joint and survivor annuity and will continue to pay his wife Jamie for her lifetime. Sean's will leaves all probate assets to his son and daughter in equal shares. Sean also owned a life insurance policy on his life. His basis in the policy was $83,000 and the death benefit was $1,000,000. The beneficiary of the insurance policy was Sean's wife. Sean's funeral cost $15,000. The car was sold 4/1/20 for its fair market value on that date in order to pay for Sean's $12,000 hand-carved marble headstone. Sean had $132,000 of medical expenses from the accident, but all expenses were covered by his medical insurance. The note receivable is being paid off $2,000 per month. Highlight the correct answer and show your work to receive partial credit. 1. What is the value of Sean's gross estate assuming the date of death valuation is selected? a. $1,107,500. b. $2,107,500. c. $2,107,000. d. $1,948,500. 2. Determine whether each of the following items is included in Sean's probate estate. a. Yes, this item is in the probate estate. b. No, this item is not included in the probate estate. 3. What is the value of Sean's marital deduction? a. $0. b. $1,360,000. c. $360,000 d. $1,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts