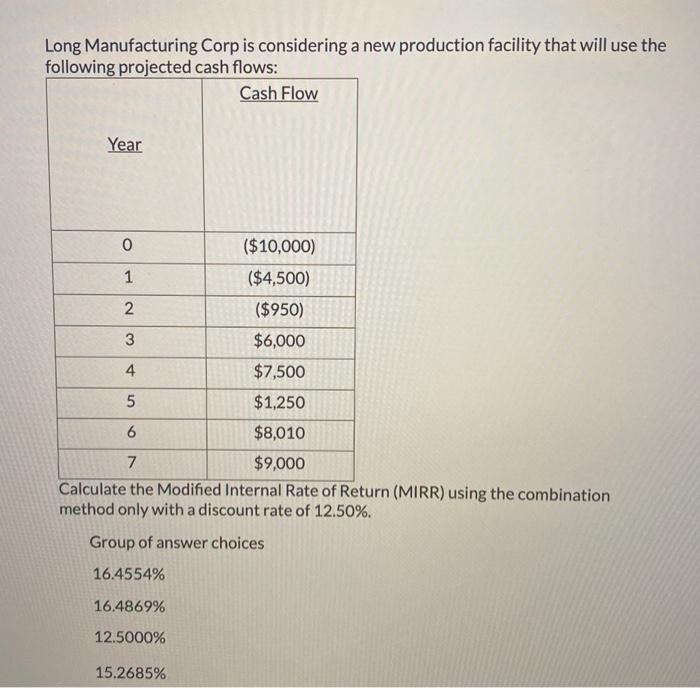

Question: Long Manufacturing Corp is considering a new production facility that will use the following projected cash flows: Cash Flow Year 0 1 ($10,000) ($4,500) ($950)

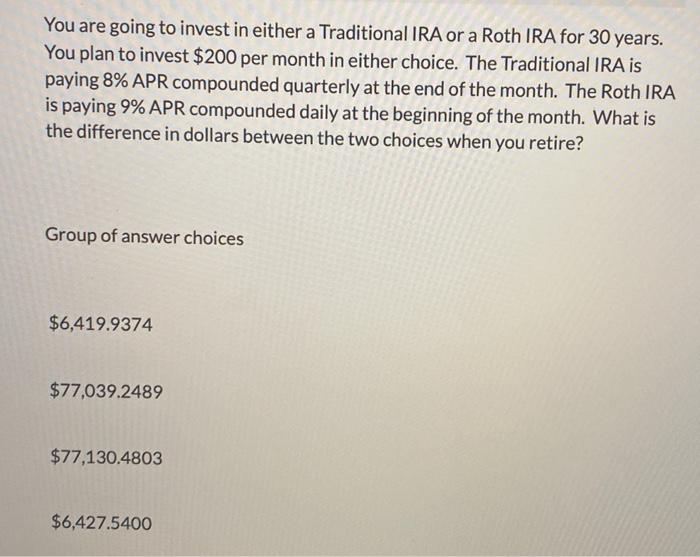

Long Manufacturing Corp is considering a new production facility that will use the following projected cash flows: Cash Flow Year 0 1 ($10,000) ($4,500) ($950) 2 3 $6,000 4 $7,500 5 $1,250 6 $8,010 7 $9,000 Calculate the Modified Internal Rate of Return (MIRR) using the combination method only with a discount rate of 12.50%. Group of answer choices 16.4554% 16.4869% 12.5000% 15.2685% You are going to invest in either a Traditional IRA or a Roth IRA for 30 years. You plan to invest $200 per month in either choice. The Traditional IRA is paying 8% APR compounded quarterly at the end of the month. The Roth IRA is paying 9% APR compounded daily at the beginning of the month. What is the difference in dollars between the two choices when you retire? Group of answer choices $6,419.9374 $77,039.2489 $77,130.4803 $6,427.5400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts