Question: Mr. Zee worked 53 hours during the week ended January 18, 20X1. He is paid $10 per hour, and is paid time and a half

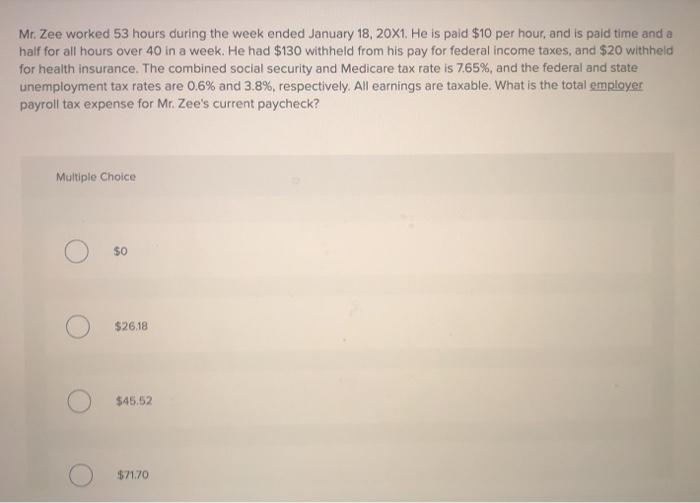

Mr. Zee worked 53 hours during the week ended January 18, 20X1. He is paid $10 per hour, and is paid time and a half for all hours over 40 in a week. He had $130 withheld from his pay for federal income taxes; and $20 withheld for health insurance. The combined social security and Medicare tax rate is 7.65%, and the federal and state unemployment tax rates are 0.6% and 3.8%, respectively. All earnings are taxable. What is the total employer payroll tax expense for Mr. Zee's current paycheck? Multiple Choice $0 $2618 $45.52 $7170

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock