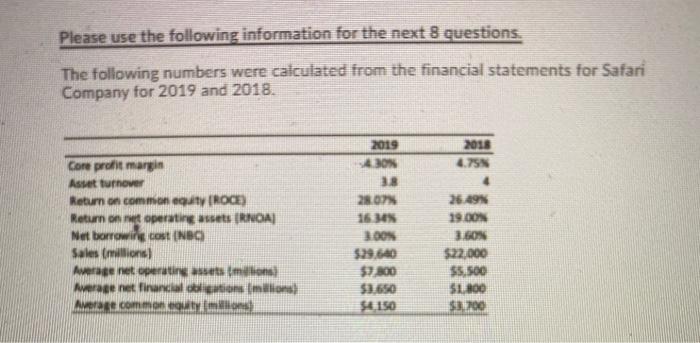

Question: Please use the following information for the next 8 questions. The following numbers were calculated from the financial statements for Safari Company for 2019 and

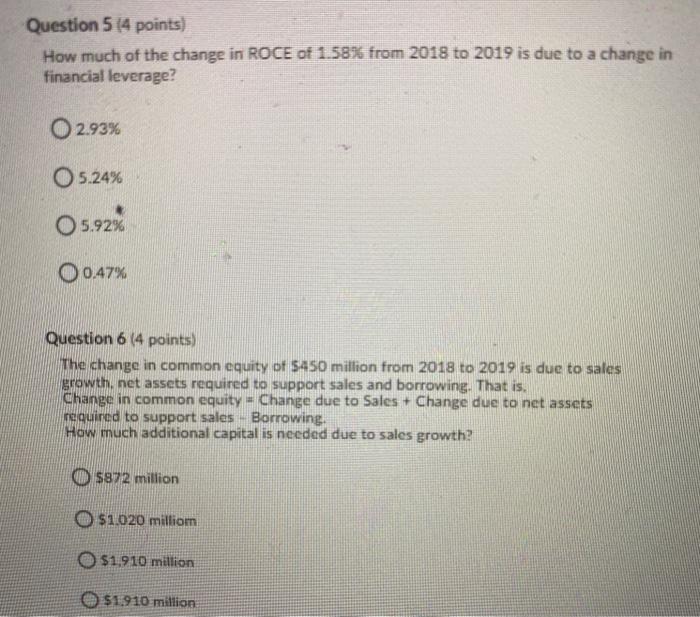

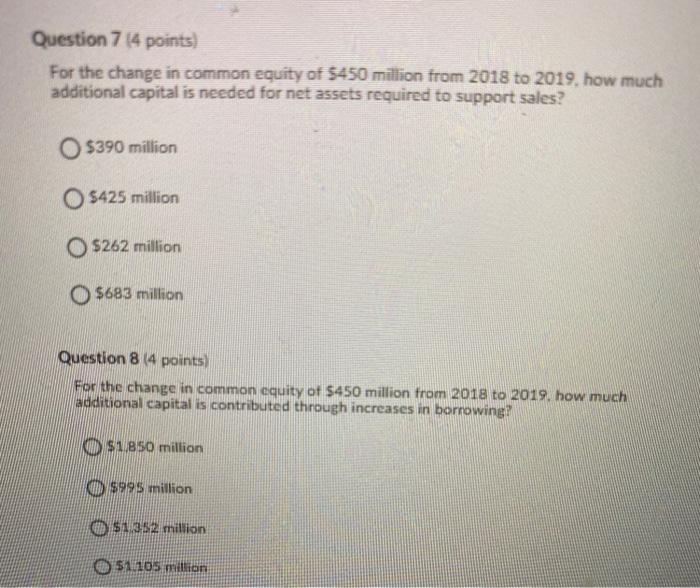

Please use the following information for the next 8 questions. The following numbers were calculated from the financial statements for Safari Company for 2019 and 2018. 2018 4.75N 2019 5430N 38 28.07% Core profit margin Asut turnover Return on common equity PROCE) Return on nyt operating assets RNDA] Net borrowing cost (NBA) Sales millions Average net operating assets milion were net financial obligations milions Are commonly ko 26.49% 19.00N 3.50N $22.000 $5,500 $1,800 9.200 $7.800 Question 5 (4 points) How much of the change in ROCE of 1.5896 from 2018 to 2019 is due to a change in financial leverage? 2.93% O 5.24% 5.92% O 0.47% Question 6 (4 points) The change in common equity of $450 million from 2018 to 2019 is due to sales Browth, net assets required to support sales and borrowing. That is Change in common equity - Change due to Sales + Change due to net assets required to support sales Borrowing, How much additional capital is needed due to sales growth 5872 million O $1020 million O $1.910 million O $1.910 million Question 7 64 points) For the change in common equity of $450 million from 2018 to 2019. how much additional capital is needed for net assets required to support sales? $390 million $425 million $262 million O $683 million Question 8 (4 points) For the change in common equity of $450 million from 2018 to 2019. how much additional capital is contributed through increases in borrowing? D$1850 million $995 million $1,952 million O Sainos million Please use the following information for the next 8 questions. The following numbers were calculated from the financial statements for Safari Company for 2019 and 2018. 2018 4.75N 2019 5430N 38 28.07% Core profit margin Asut turnover Return on common equity PROCE) Return on nyt operating assets RNDA] Net borrowing cost (NBA) Sales millions Average net operating assets milion were net financial obligations milions Are commonly ko 26.49% 19.00N 3.50N $22.000 $5,500 $1,800 9.200 $7.800 Question 5 (4 points) How much of the change in ROCE of 1.5896 from 2018 to 2019 is due to a change in financial leverage? 2.93% O 5.24% 5.92% O 0.47% Question 6 (4 points) The change in common equity of $450 million from 2018 to 2019 is due to sales Browth, net assets required to support sales and borrowing. That is Change in common equity - Change due to Sales + Change due to net assets required to support sales Borrowing, How much additional capital is needed due to sales growth 5872 million O $1020 million O $1.910 million O $1.910 million Question 7 64 points) For the change in common equity of $450 million from 2018 to 2019. how much additional capital is needed for net assets required to support sales? $390 million $425 million $262 million O $683 million Question 8 (4 points) For the change in common equity of $450 million from 2018 to 2019. how much additional capital is contributed through increases in borrowing? D$1850 million $995 million $1,952 million O Sainos million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts