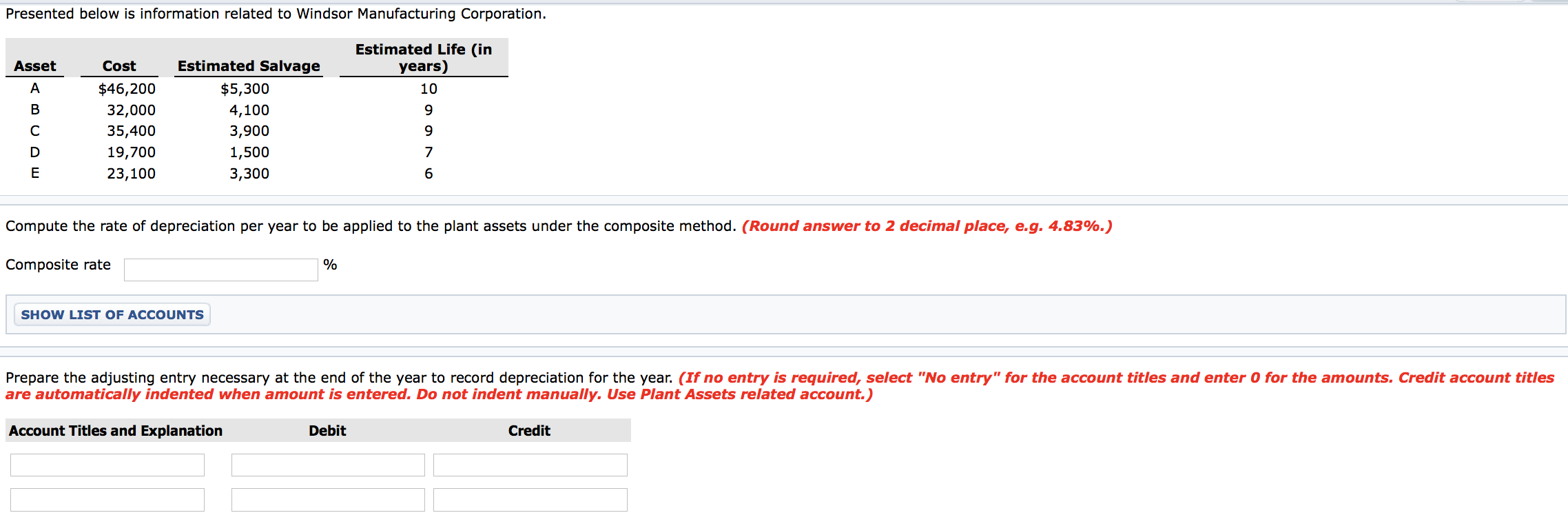

Question: Presented below is information related to Windsor Manufacturing Corporation. Asset Estimated Life (in years) 10 9 A B Cost $46,200 32,000 35,400 19,700 23,100 Estimated

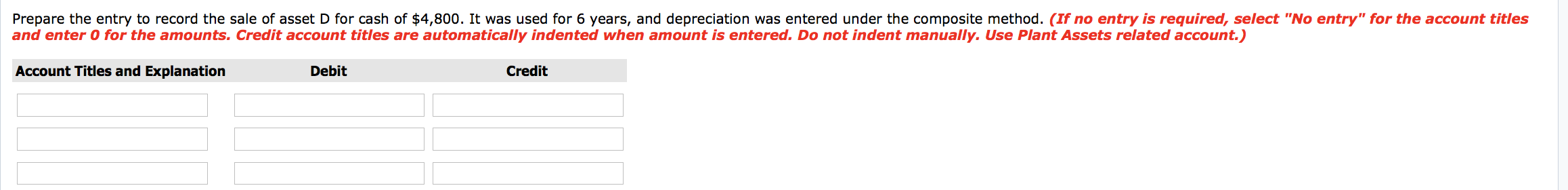

Presented below is information related to Windsor Manufacturing Corporation. Asset Estimated Life (in years) 10 9 A B Cost $46,200 32,000 35,400 19,700 23,100 Estimated Salvage $5,300 4,100 3,900 1,500 3,300 9 D 7 E 6 Compute the rate of depreciation per year to be applied to the plant assets under the composite method. (Round answer to 2 decimal place, e.g. 4.83%.) Composite rate % SHOW LIST OF ACCOUNTS Prepare the adjusting entry necessary at the end of the year to record depreciation for the year. (If no entry is required, select "No entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Use Plant Assets related account.) Account Titles and Explanation Debit Credit Prepare the entry to record the sale of asset D for cash of $4,800. It was used for 6 years, and depreciation was entered under the composite method. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Use Plant Assets related account.) Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts