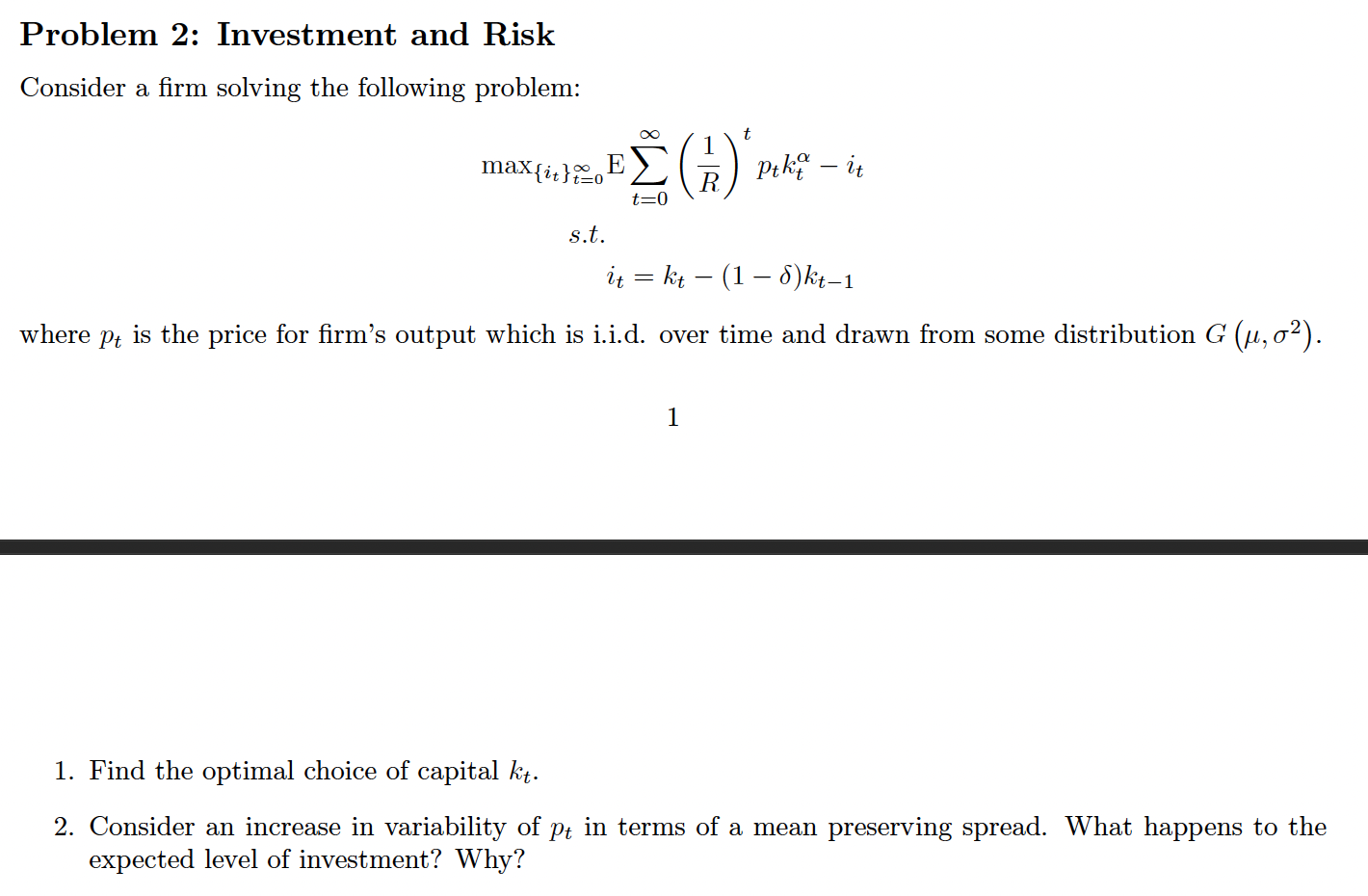

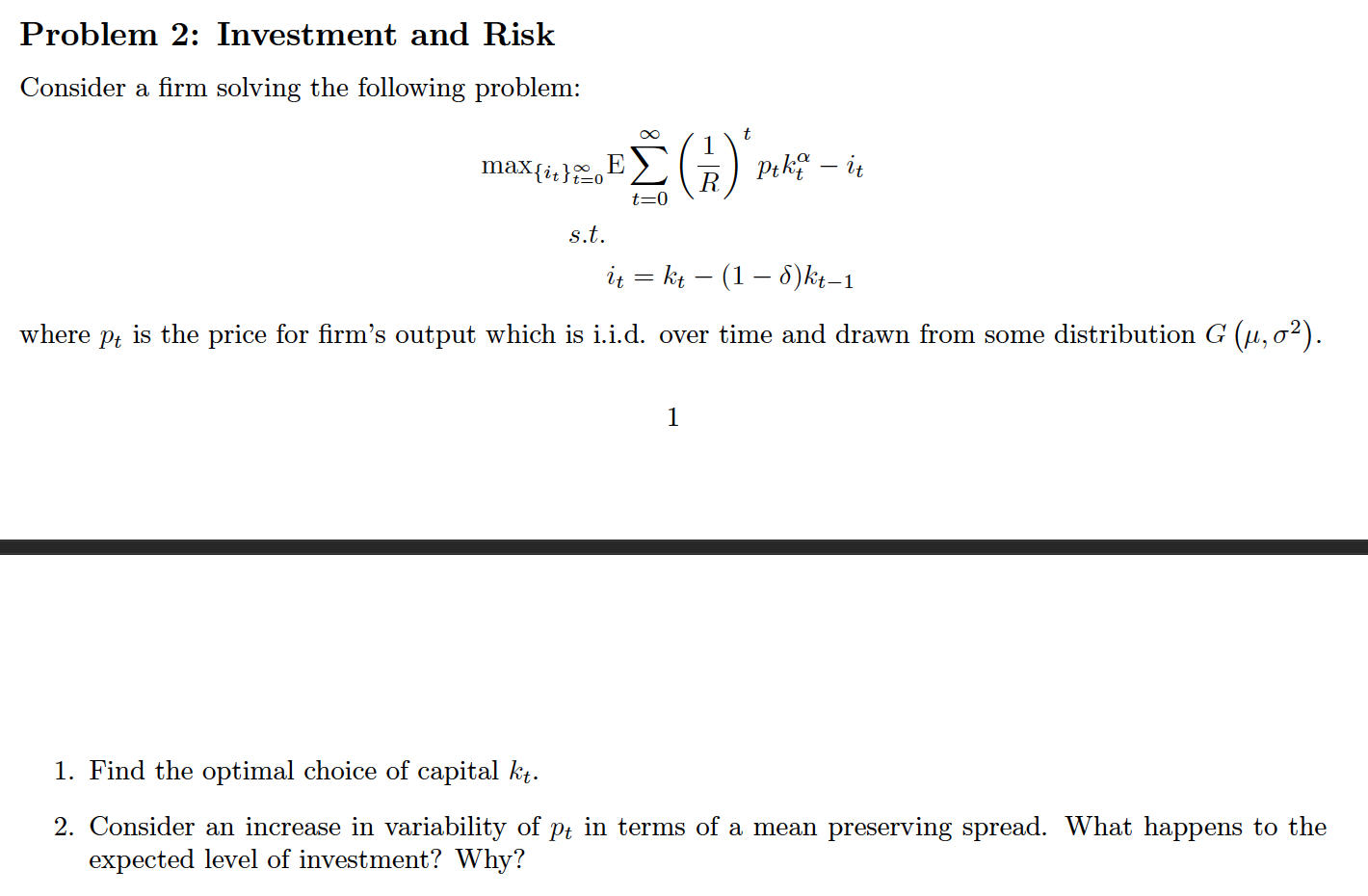

Question: Problem 2: Investment and Risk Consider a firm solving the following problem: max{it}t=0Et=0(R1)tptktits.t.it=kt(1)kt1 where pt is the price for firm's output which is i.i.d. over

Problem 2: Investment and Risk Consider a firm solving the following problem: max{it}t=0Et=0(R1)tptktits.t.it=kt(1)kt1 where pt is the price for firm's output which is i.i.d. over time and drawn from some distribution G(,2). 1 1. Find the optimal choice of capital kt. 2. Consider an increase in variability of pt in terms of a mean preserving spread. What happens to the expected level of investment? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts