Question: Problem 28-4 The difference between a Roth IRA and a traditional IRA is that in a Roth IRA taxes are paid on the income that

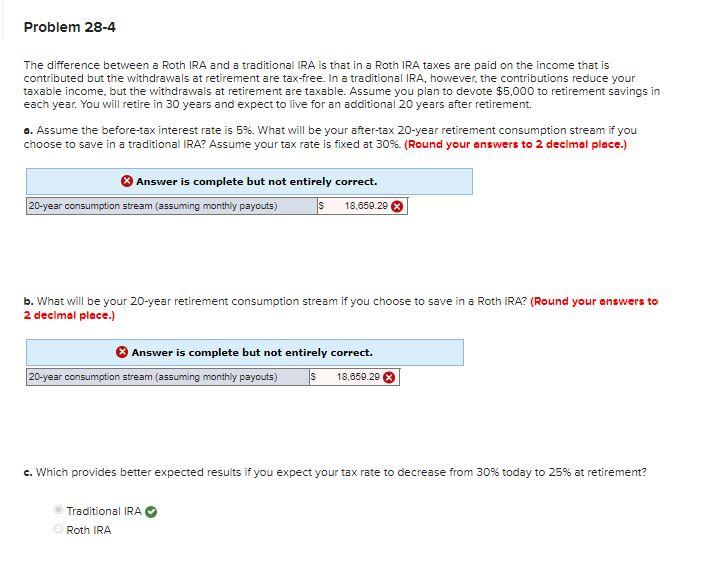

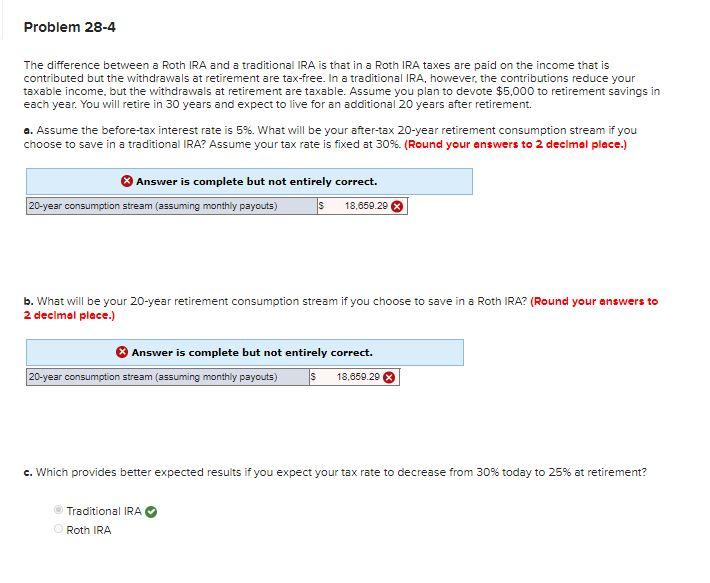

Problem 28-4 The difference between a Roth IRA and a traditional IRA is that in a Roth IRA taxes are paid on the income that is contributed but the withdrawals at retirement are tax-free. In a traditional IRA, however, the contributions reduce your taxable income, but the withdrawals at retirement are taxable. Assume you plan to devote $5,000 to retirement savings in each year. You will retire in 30 years and expect to live for an additional 20 years after retirement a. Assume the before-tax interest rate is 5%. What will be your after-tax 20-year retirement consumption stream if you choose to save in a traditional IRA? Assume your tax rate is fixed at 30%. (Round your answers to 2 decimal place.) Answer is complete but not entirely correct. 20-year consumption stream (assuming monthly payouts) s 18,659.29 b. What will be your 20-year retirement consumption stream if you choose to save in a Roth IRA? (Round your answers to 2 decimal place.) Answer is complete but not entirely correct. 20-year consumption stream (assuming monthly payouts) s 18,650.20 c. Which provides better expected results if you expect your tax rate to decrease from 30% today to 25% at retirement? Traditional IRA Roth IRA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts