Question: Problem 8.9.18. (Exercise probability for an exchange option) Assume the Black- Scholes framework. You are given the following information about two stocks: (i) Current share

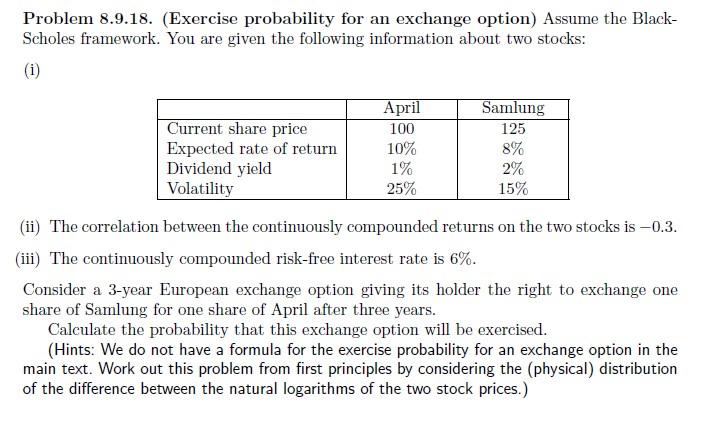

Problem 8.9.18. (Exercise probability for an exchange option) Assume the Black- Scholes framework. You are given the following information about two stocks: (i) Current share price Expected rate of return Dividend yield Volatility April 100 10% 1% 25% Samlung 125 8% 2% 15% (ii) The correlation between the continuously compounded returns on the two stocks is -0.3. (iii) The continuously compounded risk-free interest rate is 6%. Consider a 3-year European exchange option giving its holder the right to exchange one share of Samlung for one share of April after three years. Calculate the probability that this exchange option will be exercised. (Hints: We do not have a formula for the exercise probability for an exchange option in the main text. Work out this problem from first principles by considering the (physical) distribution of the difference between the natural logarithms of the two stock prices.) Problem 8.9.18. (Exercise probability for an exchange option) Assume the Black- Scholes framework. You are given the following information about two stocks: (i) Current share price Expected rate of return Dividend yield Volatility April 100 10% 1% 25% Samlung 125 8% 2% 15% (ii) The correlation between the continuously compounded returns on the two stocks is -0.3. (iii) The continuously compounded risk-free interest rate is 6%. Consider a 3-year European exchange option giving its holder the right to exchange one share of Samlung for one share of April after three years. Calculate the probability that this exchange option will be exercised. (Hints: We do not have a formula for the exercise probability for an exchange option in the main text. Work out this problem from first principles by considering the (physical) distribution of the difference between the natural logarithms of the two stock prices.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts