Question: Problem E Recall Huberman, Gur, and Tomer Regev. Contagious Speculation and a Cure for Cancer: A Nonevent that Made Stock Prices Soar, Journal of Finance,

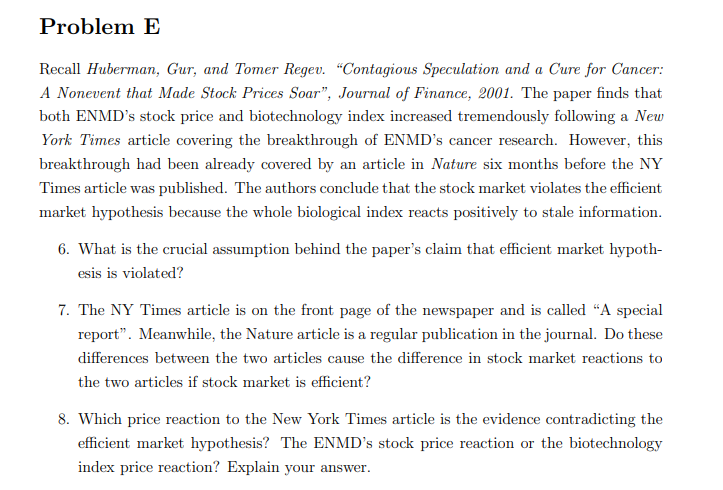

Problem E Recall Huberman, Gur, and Tomer Regev. "Contagious Speculation and a Cure for Cancer: A Nonevent that Made Stock Prices Soar, Journal of Finance, 2001. The paper finds that both ENMD's stock price and biotechnology index increased tremendously following a New York Times article covering the breakthrough of ENMD's cancer research. However, this breakthrough had been already covered by an article in Nature six months before the NY Times article was published. The authors conclude that the stock market violates the efficient market hypothesis because the whole biological index reacts positively to stale information. 6. What is the crucial assumption behind the paper's claim that efficient market hypoth- esis is violated? 7. The NY Times article is on the front page of the newspaper and is called A special report". Meanwhile, the Nature article is a regular publication in the journal. Do these differences between the two articles cause the difference in stock market reactions to the two articles if stock market is efficient? 8. Which price reaction to the New York Times article is the evidence contradicting the efficient market hypothesis? The ENMD's stock price reaction or the biotechnology index price reaction? Explain your answer. Problem E Recall Huberman, Gur, and Tomer Regev. "Contagious Speculation and a Cure for Cancer: A Nonevent that Made Stock Prices Soar, Journal of Finance, 2001. The paper finds that both ENMD's stock price and biotechnology index increased tremendously following a New York Times article covering the breakthrough of ENMD's cancer research. However, this breakthrough had been already covered by an article in Nature six months before the NY Times article was published. The authors conclude that the stock market violates the efficient market hypothesis because the whole biological index reacts positively to stale information. 6. What is the crucial assumption behind the paper's claim that efficient market hypoth- esis is violated? 7. The NY Times article is on the front page of the newspaper and is called A special report". Meanwhile, the Nature article is a regular publication in the journal. Do these differences between the two articles cause the difference in stock market reactions to the two articles if stock market is efficient? 8. Which price reaction to the New York Times article is the evidence contradicting the efficient market hypothesis? The ENMD's stock price reaction or the biotechnology index price reaction? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts