Question: Question 1 --/1 View Policies Current Attempt in Progress Will Jones, Blossom is a small CPA firm that focuses primarily on preparing tax returns for

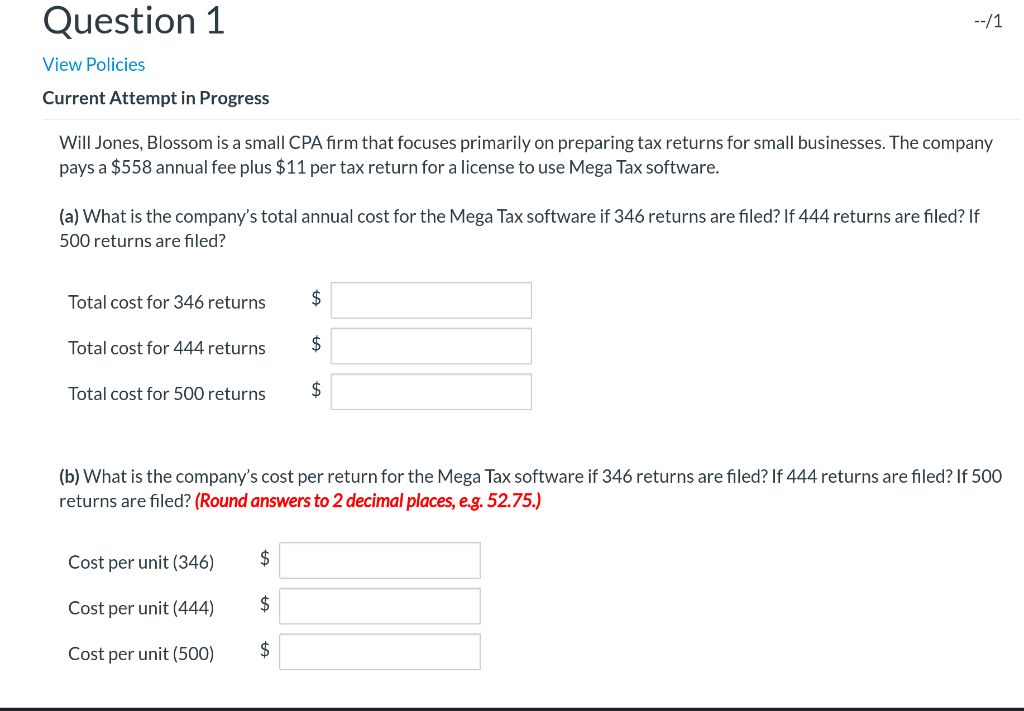

Question 1 --/1 View Policies Current Attempt in Progress Will Jones, Blossom is a small CPA firm that focuses primarily on preparing tax returns for small businesses. The company pays a $558 annual fee plus $11 per tax return for a license to use Mega Tax software. (a) What is the company's total annual cost for the Mega Tax software if 346 returns are filed? If 444 returns are filed? If 500 returns are filed? Total cost for 346 returns 0 Total cost for 444 returns 0 Total cost for 500 returns 0 (b) What is the company's cost per return for the Mega Tax software if 346 returns are filed? If 444 returns are filed? If 500 returns are filed? (Round answers to 2 decimal places, e.g. 52.75.) Cost per unit (346) A Cost per unit (444) A Cost per unit(500) A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts