Question: Question 1 [19 marks] The following information is related to Wishbox Inc. during the fiscal year ended on 31 December 2017. 2016 Consolidated statement of

![Question 1 [19 marks] The following information is related to Wishbox](https://s3.amazonaws.com/si.experts.images/answers/2024/06/667b08833f95e_139667b0883360c0.jpg)

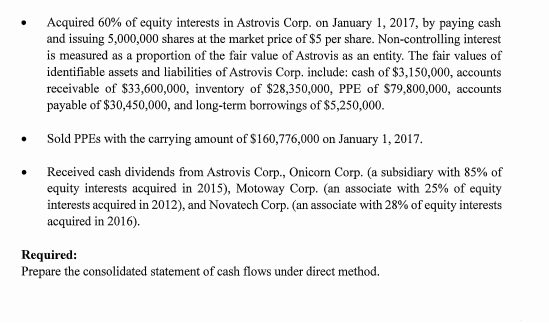

Question 1 [19 marks] The following information is related to Wishbox Inc. during the fiscal year ended on 31 December 2017. 2016 Consolidated statement of financial position (Unit: 8) 2017 Assets Cash 324,670,000 Accounts receivable 626,640,000 Inventory 808,500,000 PPE (net) 1,011,150,000 Investment in associates 441,000,000 Goodwill 96,285,000 Liabilities Accounts payable 840,000,000 Interest payable 31,500,000 Income tax payable 115,500,000 Long-term borrowings 336,000,000 Equity Share capital 953,200,000 Retained earnings 994,980,000 Non-controlling interests 37,065,000 425,250,000 593,880,000 678,300,000 803,880,000 420,000,000 87,360,000 814,590,000 28,350,000 101,640,000 403,200,000 928,200,000 700,350,000 32,340,000 Consolidated income statement (Unit: $) Sales Cost of goods sold Salaries expense Depreciation expense Interest expense Gain on sale of PPE Share of profit from associates Income before tax Income tax expense Net income Attributable to: Company's shareholders Non-controlling interests 2017 2,562,000,000 (1,813,350,000) (142,380,000) (112,350,000) (32,340,000) 24,780,000 42,000,000 528,360,000 (101,430,000) 426,930,000 410,130,000 16,800,000 Acquired 60% of equity interests in Astrovis Corp. on January 1, 2017, by paying cash and issuing 5,000,000 shares at the market price of $5 per share. Non-controlling interest is measured as a proportion of the fair value of Astrovis as an entity. The fair values of identifiable assets and liabilities of Astrovis Corp, include: cash of $3,150,000, accounts receivable of $33,600,000, inventory of $28,350,000, PPE of $79,800,000, accounts payable of $30,450,000, and long-term borrowings of $5,250,000. Sold PPEs with the carrying amount of $160,776,000 on January 1, 2017. Received cash dividends from Astrovis Corp., Onicorn Corp. (a subsidiary with 85% of equity interests acquired in 2015), Motoway Corp. (an associate with 25% of equity interests acquired in 2012), and Novatech Corp. (an associate with 28% of equity interests acquired in 2016). Required: Prepare the consolidated statement of cash flows under direct method. Question 1 [19 marks] The following information is related to Wishbox Inc. during the fiscal year ended on 31 December 2017. 2016 Consolidated statement of financial position (Unit: 8) 2017 Assets Cash 324,670,000 Accounts receivable 626,640,000 Inventory 808,500,000 PPE (net) 1,011,150,000 Investment in associates 441,000,000 Goodwill 96,285,000 Liabilities Accounts payable 840,000,000 Interest payable 31,500,000 Income tax payable 115,500,000 Long-term borrowings 336,000,000 Equity Share capital 953,200,000 Retained earnings 994,980,000 Non-controlling interests 37,065,000 425,250,000 593,880,000 678,300,000 803,880,000 420,000,000 87,360,000 814,590,000 28,350,000 101,640,000 403,200,000 928,200,000 700,350,000 32,340,000 Consolidated income statement (Unit: $) Sales Cost of goods sold Salaries expense Depreciation expense Interest expense Gain on sale of PPE Share of profit from associates Income before tax Income tax expense Net income Attributable to: Company's shareholders Non-controlling interests 2017 2,562,000,000 (1,813,350,000) (142,380,000) (112,350,000) (32,340,000) 24,780,000 42,000,000 528,360,000 (101,430,000) 426,930,000 410,130,000 16,800,000 Acquired 60% of equity interests in Astrovis Corp. on January 1, 2017, by paying cash and issuing 5,000,000 shares at the market price of $5 per share. Non-controlling interest is measured as a proportion of the fair value of Astrovis as an entity. The fair values of identifiable assets and liabilities of Astrovis Corp, include: cash of $3,150,000, accounts receivable of $33,600,000, inventory of $28,350,000, PPE of $79,800,000, accounts payable of $30,450,000, and long-term borrowings of $5,250,000. Sold PPEs with the carrying amount of $160,776,000 on January 1, 2017. Received cash dividends from Astrovis Corp., Onicorn Corp. (a subsidiary with 85% of equity interests acquired in 2015), Motoway Corp. (an associate with 25% of equity interests acquired in 2012), and Novatech Corp. (an associate with 28% of equity interests acquired in 2016). Required: Prepare the consolidated statement of cash flows under direct method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts