Question: Question 1: MM Proposition 1 Suppose Alpha Industries and Omega Technology have identical assets that generate identical cash flows. Alpha Industries is an all-equity firm,

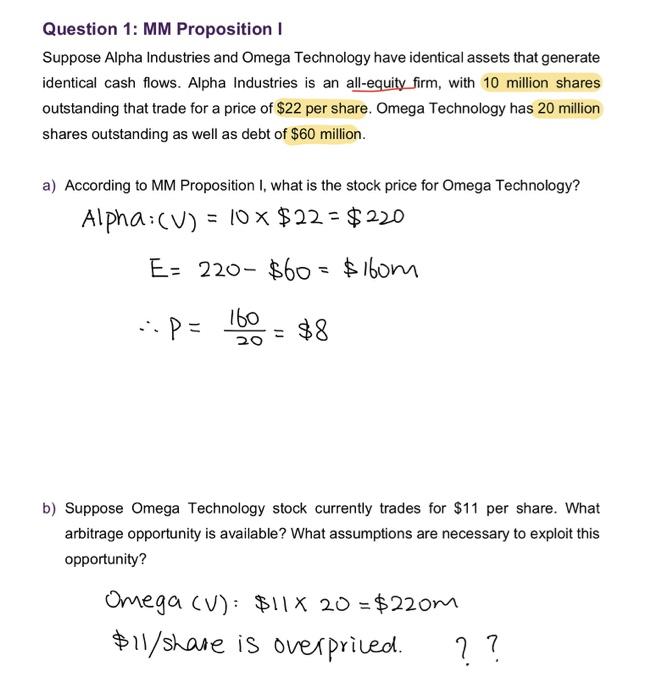

Question 1: MM Proposition 1 Suppose Alpha Industries and Omega Technology have identical assets that generate identical cash flows. Alpha Industries is an all-equity firm, with 10 million shares outstanding that trade for a price of $22 per share. Omega Technology has 20 million shares outstanding as well as debt of $60 million. a) According to MM Proposition I, what is the stock price for Omega Technology? Alpha:(V) = 10 x $22 - $220 E: 220- $60 = $ 160m 160 = $8 20 b) Suppose Omega Technology stock currently trades for $11 per share. What arbitrage opportunity is available? What assumptions are necessary to exploit this opportunity? Omega (V): $11% 20 = $220m $11/share is overpriced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts