Question: Question 10 (2 points) A firm has $800,000 in receivables which it sells to a factor at a 2% discount. The average collection period is

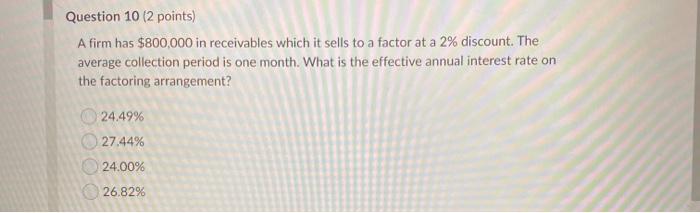

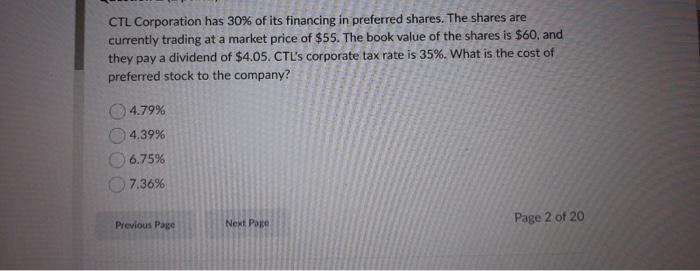

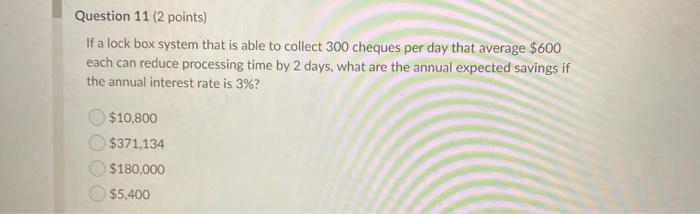

Question 10 (2 points) A firm has $800,000 in receivables which it sells to a factor at a 2% discount. The average collection period is one month. What is the effective annual interest rate on the factoring arrangement? 24.49% 27.44% 24.00% 26.82% CTL Corporation has 30% of its financing in preferred shares. The shares are currently trading at a market price of $55. The book value of the shares is $60, and they pay a dividend of $4.05. CTL's corporate tax rate is 35%. What is the cost of preferred stock to the company? 4.79% 4.39% 6.7596 7.36% Previous Page Next Page Page 2 of 20 Question 11 (2 points) If a lock box system that is able to collect 300 cheques per day that average $600 each can reduce processing time by 2 days, what are the annual expected savings if the annual interest rate is 3%? $10.800 $371,134 $180,000 $5,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts