Question: Question 12 4 pts When evaluating a single capital budgeting project, the Net Present Value method and the Internal Rate of Return method will always

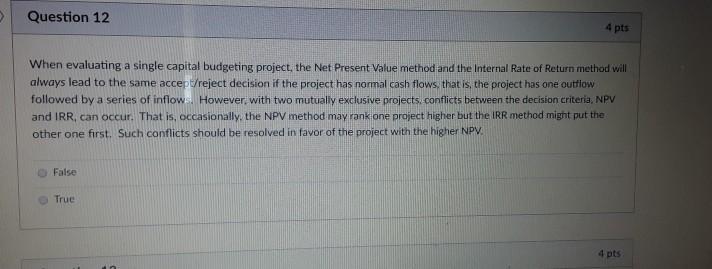

Question 12 4 pts When evaluating a single capital budgeting project, the Net Present Value method and the Internal Rate of Return method will always lead to the same accept/reject decision if the project has normal cash flows that is, the project has one outflow followed by a series of inflows. However, with two mutually exclusive projects, conflicts between the decision criteria. NPV and IRR, can occur. That is, occasionally, the NPV method may rank one project higher but the IRR method might put the other one first. Such conflicts should be resolved in favor of the project with the higher NPV False True 4 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts