Question: QUESTION 2 (12 marks) Smith Company started its business on November 1, 2020, below is the information needed to prepare a bank reconciliation for the

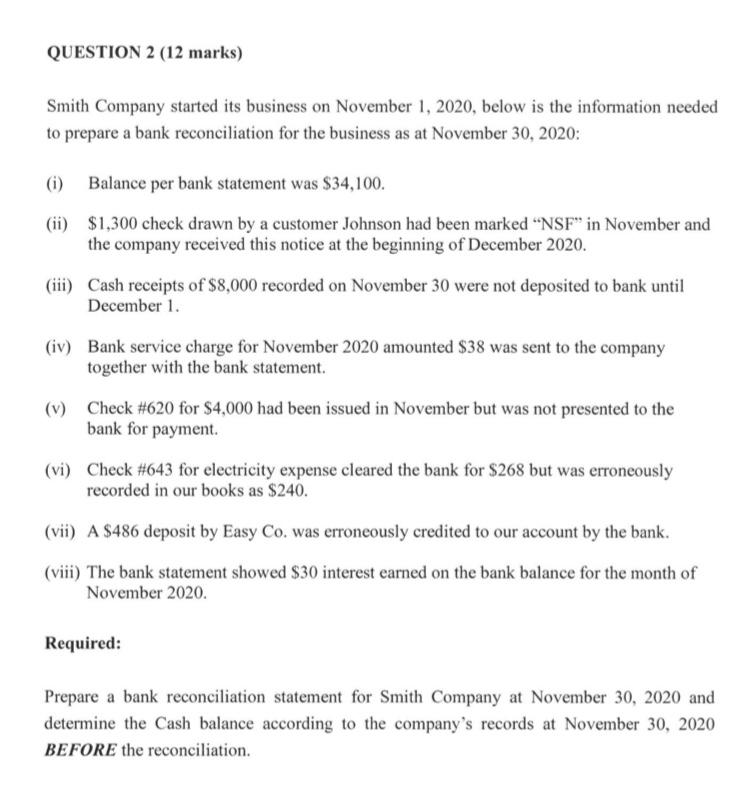

QUESTION 2 (12 marks) Smith Company started its business on November 1, 2020, below is the information needed to prepare a bank reconciliation for the business as at November 30, 2020: (ii) (i) Balance per bank statement was $34,100. $1,300 check drawn by a customer Johnson had been marked "NSF in November and the company received this notice at the beginning of December 2020. (iii) Cash receipts of $8,000 recorded on November 30 were not deposited to bank until December 1. (iv) Bank service charge for November 2020 amounted $38 was sent to the company together with the bank statement. (v) Check #620 for $4,000 had been issued in November but was not presented to the bank for payment. (vi) Check #643 for electricity expense cleared the bank for $268 but was erroneously recorded in our books as $240. (vii) A $486 deposit by Easy Co. was erroneously credited to our account by the bank. (viii) The bank statement showed $30 interest earned on the bank balance for the month of November 2020. Required: Prepare a bank reconciliation statement for Smith Company at November 30, 2020 and determine the Cash balance according to the company's records at November 30, 2020 BEFORE the reconciliation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts