Question: Question 3 0.34 / 0.34 pts On May 1, 2020, a company issued a $10,000, 3%, note payable to purchase equipment. The note term is

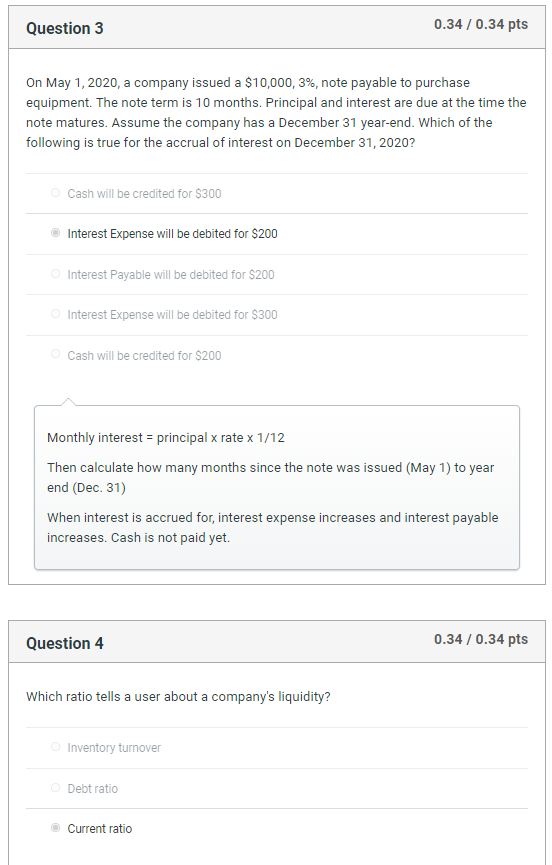

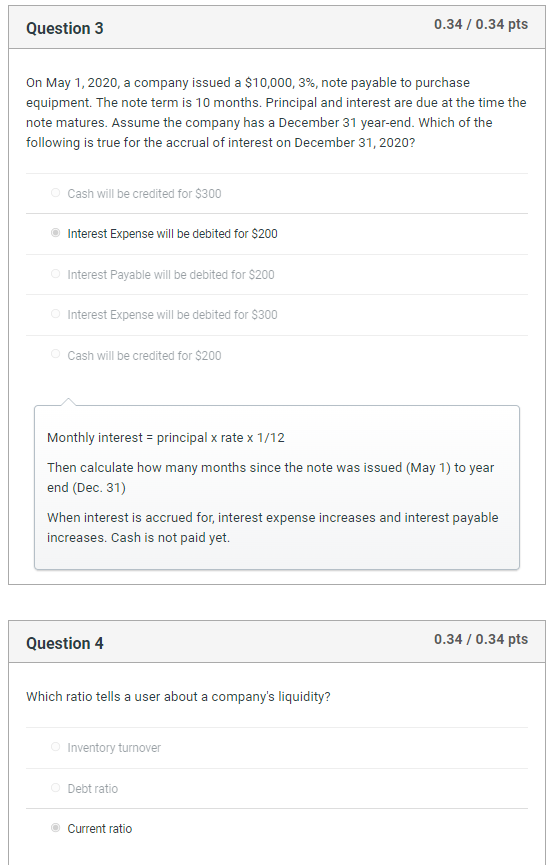

Question 3 0.34 / 0.34 pts On May 1, 2020, a company issued a $10,000, 3%, note payable to purchase equipment. The note term is 10 months. Principal and interest are due at the time the note matures. Assume the company has a December 31 year-end. Which of the following is true for the accrual of interest on December 31, 2020? Cash will be credited for $300 Interest Expense will be debited for $200 O Interest Payable will be debited for $200 O Interest Expense will be debited for $300 O Cash will be credited for $200 Monthly interest = principal x rate x 1/12 Then calculate how many months since the note was issued (May 1) to year end (Dec. 31) When interest is accrued for, interest expense increases and interest payable increases. Cash is not paid yet. Question 4 0.34 / 0.34 pts Which ratio tells a user about a company's liquidity? Inventory turnover O Debt ratio Current ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts