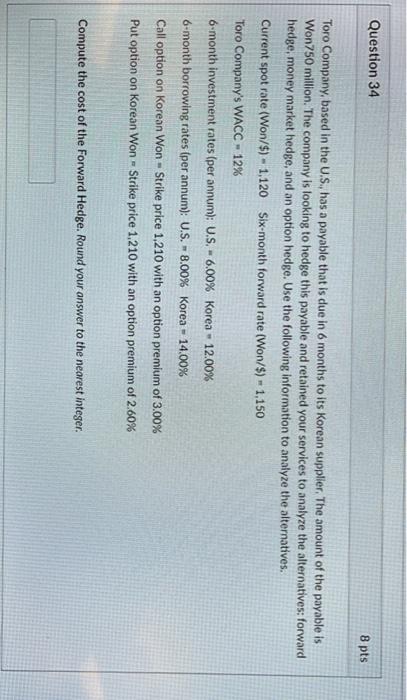

Question: Question 34 8 pts Toro Company, based in the U.S., has a payable that is due in 6 months to its Korean supplier. The amount

Question 34 8 pts Toro Company, based in the U.S., has a payable that is due in 6 months to its Korean supplier. The amount of the payable is Won750 million. The company is looking to hedge this payable and retained your services to analyze the alternatives: forward hedge, money market hedge, and an option hedge. Use the following information to analyze the alternatives. Current spot rate (Won/$) - 1,120 Six-month forward rate (Won/$) - 1,150 Toro Company's WACC - 12% 6 month investment rates (per annum): U.S. - 6.00% Korea - 12.00% 6-month borrowing rates (per annum): U.S. - 8.00% Korea - 14.00% Call option on Korean Won - Strike price 1,210 with an option premium of 3.00% Put option on Korean Won - Strike price 1.210 with an option premium of 2.60% Compute the cost of the Forward Hedge. Round your answer to the nearest integer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts