Question: Question 3A (3 marks) Precious Glove Ltd, paid a dividend of $5.00 per share on its ordinary shares recently. The share is currently trading at

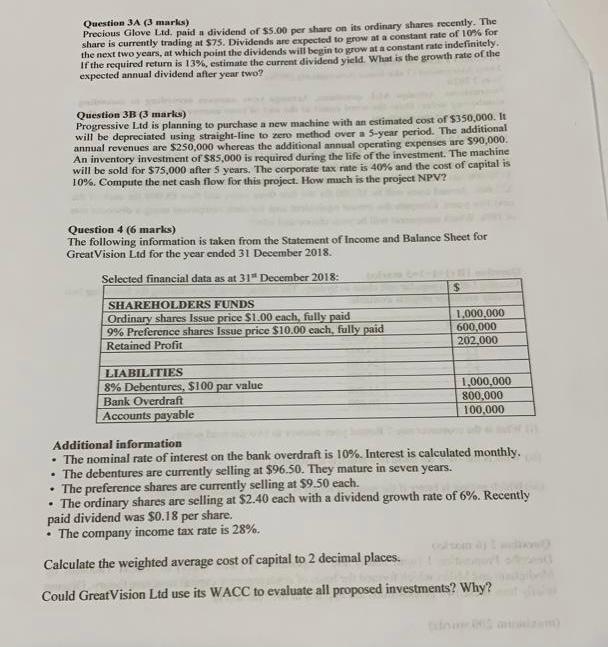

Question 3A (3 marks) Precious Glove Ltd, paid a dividend of $5.00 per share on its ordinary shares recently. The share is currently trading at $75. Dividends are expected to grow at a constant rate of 10% for the next two years, at which point the dividends will begin to grow at a constant rate indefinitely. If the required return is 13%, estimate the current dividend yield. What is the growth rate of the expected annual dividend after year two? Question 3B (3 marks) Progressive Lid is planning to purchase a new machine with an estimated cost of $350,000. It will be depreciated using straight-line to zero method over a 5-year period. The additional annual revenues are $250,000 whereas the additional annual operating expenses are $90,000. An inventory investment of $85,000 is required during the life of the investment. The machine will be sold for $75,000 after 5 years. The corporate tax rate is 40% and the cost of capital is 10%. Compute the net cash flow for this project. How much is the project NPV? Question 4 (6 marks) The following information is taken from the Statement of Income and Balance Sheet for GreatVision Ltd for the year ended 31 December 2018 Selected financial data as at 31 December 2018: SHAREHOLDERS FUNDS Ordinary shares Issue price $1.00 each, fully paid 9% Preference shares Issue price $10.00 each, fully paid Retained Profit 1.000.000 600,000 202.000 LIABILITIES 8% Debentures, $100 par value Bank Overdraft Accounts payable 1,000,000 800,000 100,000 Additional information The nominal rate of interest on the bank overdraft is 10%. Interest is calculated monthly, The debentures are currently selling at $96.50. They mature in seven years. The preference shares are currently selling at $9.50 each. The ordinary shares are selling at $2.40 cach with a dividend growth rate of 6%. Recently paid dividend was $0.18 per share. The company income tax rate is 28%. Calculate the weighted average cost of capital to 2 decimal places. Could Great Vision Ltd use its WACC to evaluate all proposed investments? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts