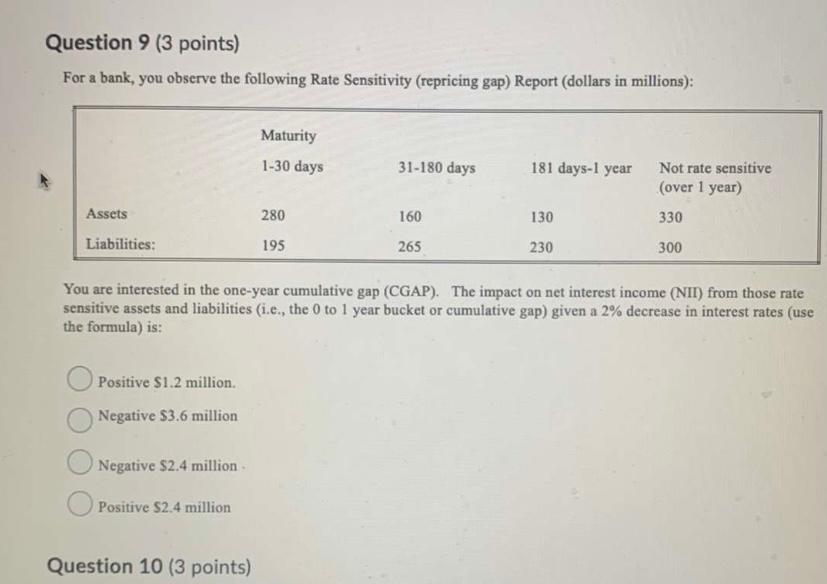

Question: Question 9 (3 points) For a bank, you observe the following Rate Sensitivity (repricing gap) Report (dollars in millions): Maturity 1-30 days 31-180 days 181

Question 9 (3 points) For a bank, you observe the following Rate Sensitivity (repricing gap) Report (dollars in millions): Maturity 1-30 days 31-180 days 181 days-1 year Not rate sensitive (over 1 year) 330 Assets 280 160 130 Liabilities: 195 265 230 300 You are interested in the one-year cumulative gap (CGAP). The impact on net interest income (NII) from those rate sensitive assets and liabilities (i.e., the 0 to 1 year bucket or cumulative gap) given a 2% decrease in interest rates (use the formula) is: Positive $1.2 million. Negative $3.6 million Negative $2.4 million Positive $2.4 million Question 10 (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts