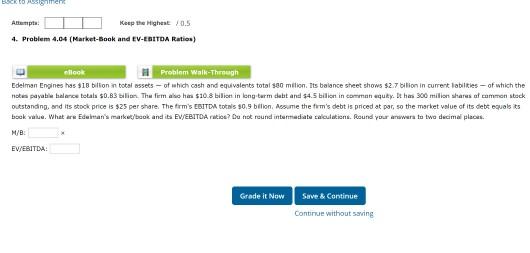

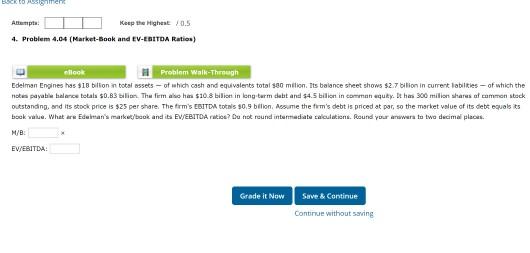

Question: t. . Keep the Highest/0.5 4. Problem 4.0 (Market-Book and EV-EBITDA Ratio) ellos Problem Walk-through Edelman Engines has 518 billion in total assets- of which

t. . Keep the Highest/0.5 4. Problem 4.0 (Market-Book and EV-EBITDA Ratio) ellos Problem Walk-through Edelman Engines has 518 billion in total assets- of which cash and equivalents total se milion. Its balance sheet shows $2.7 billion in current abilities of which the hobea payabili belence total $0.83 bilion. The firm also has $10.8 bilio in long-term cubit and $4.5 billion in commanaquly. Bt has 300 milion shares of common stock Outstanding, and its stock price is $25 per share. The firm's EBITDA to 50.9 bilion. Assume the firm's debt is priced at par, so the market value of its debt equals its boek value. What are Edelman's market/book and its EV/EBITDA ratica? Du nok round intermediate calculations. Round your answer to two decimal plous. ME EV/EBITDA Grade it Now Suve & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts