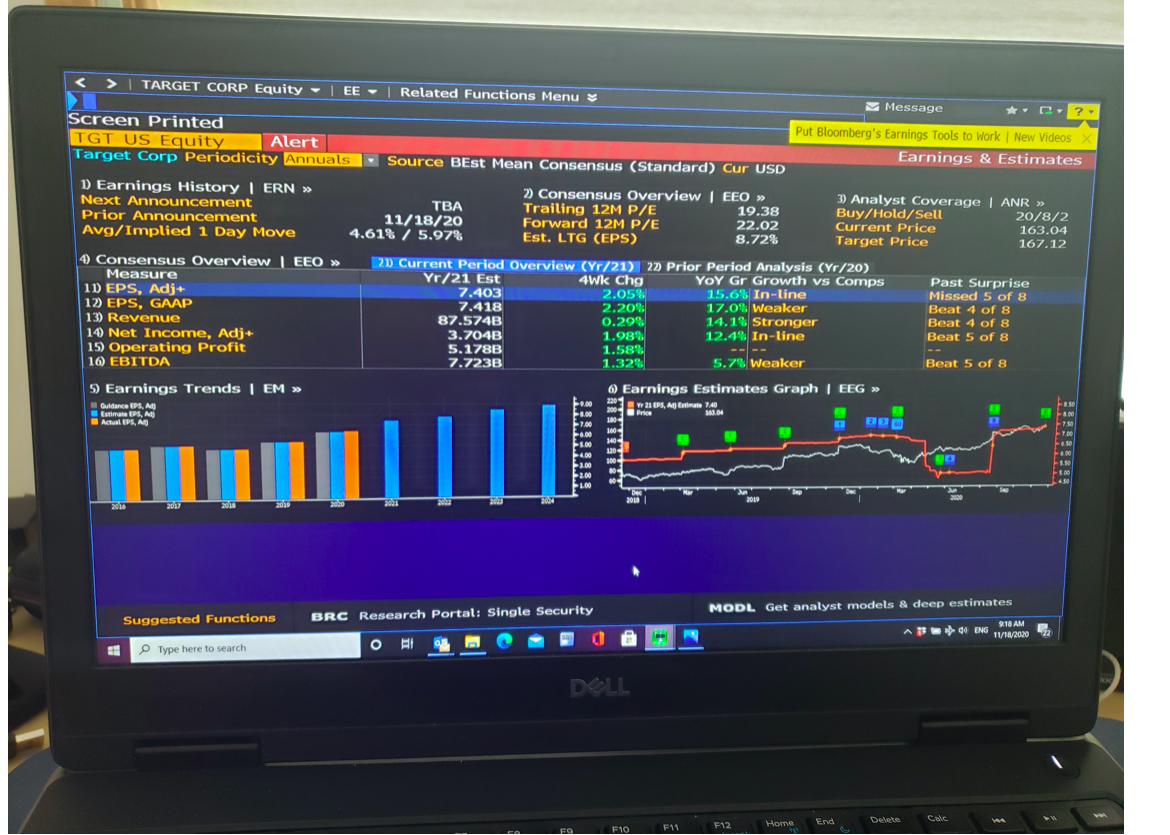

Question: TARGET CORP Equity - EE - Related Functions Menu Message * C.? Screen Printed Put Bloomberg's Earnings Tools to Work | New Videos X TGT

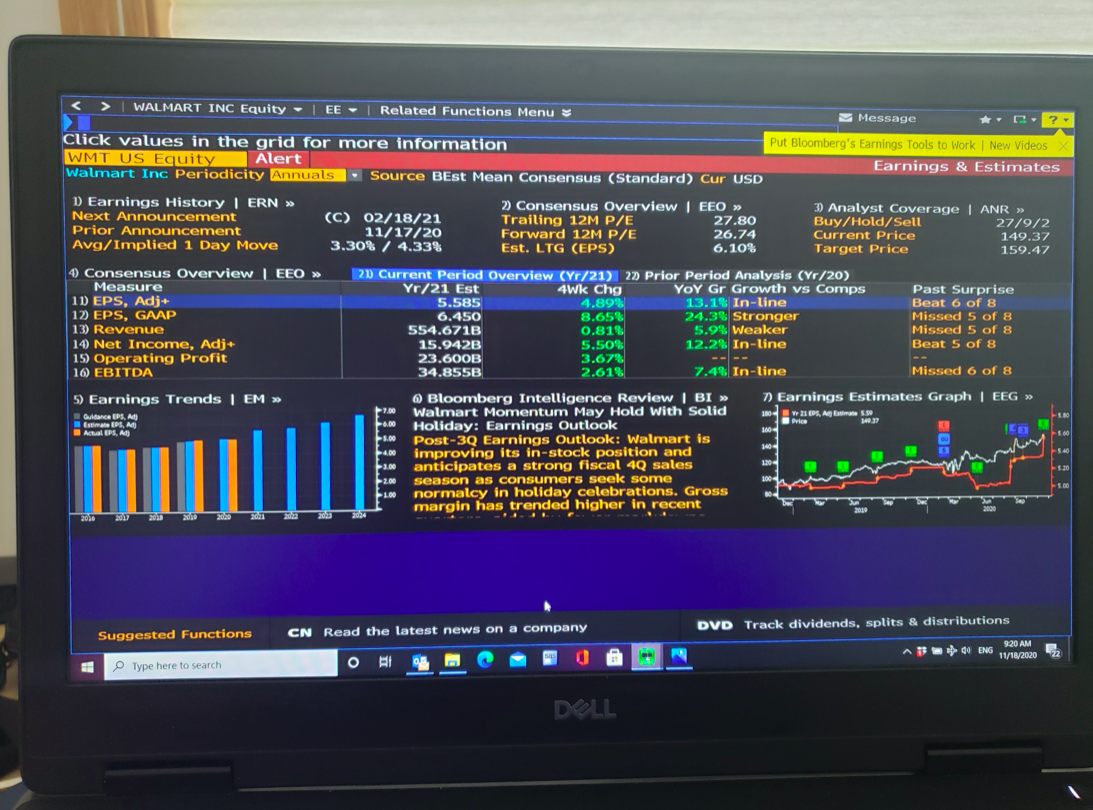

TARGET CORP Equity - EE - Related Functions Menu Message * C.? Screen Printed Put Bloomberg's Earnings Tools to Work | New Videos X TGT US Equity Alert Target Corp Periodicity Annuals Source BEst Mean Consensus (Standard) Cur USD Earnings & Estimates 1 Earnings History | ERN Consensus Overview | EEO >> Next Announcement 3) Analyst Coverage | ANR TBA Trailing 12M P/E 19.38 Prior Announcement Buy/Hold/Sell 20/8/2 11/18/20 Forward 12M P/E 22.02 4.61% / 5.97% Current Price Avg/Implied 1 Day Move 163.04 Est. LTG (EPS) 8.72% Target Price 167.12 4) Consensus Overview | EEO >> 21) Current Period Overview (Yr/21) 22 Prior Period Analysis (Yr/20) Measure Yr/21 Est 4Wk Chg YOY Gr Growth vs Comps Past Surprise 11 EPS, Adj+ 7.403 2.05% 15.6% In-line Missed 5 of 8 12 EPS, GAAP 7.418 2.20% 17.0% Weaker Beat 4 of 8 13) Revenue 87.574B 0.29% 14.18 Stronger Beat 4 of 8 14) Net Income, Adj+ 3.704B 1.98% 12.4% In-line Beat 5 of 8 15) Operating Profit 5.178B 1.58% 16) EBITDA 7.723B 1.32% 5.7% Weaker Beat 5 of 8 5) Earnings Trends | EM >> 6 Earnings Estimates Graph | EEG >> Guidance EPS, AG) W 21 EPS, Ady Estiu 1.40 16.01 Estimate EPS, Ad 7.50 Actual UPS, A 700 140 6.00 ED 3.00 500 0.00 220 200 Pro 7.00 6.00 1.00 2019 2002 2018 2020 MODL Get analyst models & deep estimates Suggested Functions BRC Research Portal: Single Security ENG 9:18 AM 11/18/2020 E Type here to search DOLL Delete End Calc F11 F12 Home F10 FO WALMART INC Equity - | EE - Related Functions Menu Message ? Click values in the grid for more information Put Bloomberg's Earnings Tools to Work | New Videos WMT US Equity Alert Earnings & Estimates Walmart Inc Periodicity Annuals Source BEst Mean Consensus (Standard) Cur USD 1 Earnings History | ERN 2) Consensus Overview | EEO Next Announcement (C) 02/18/21 3) Analyst Coverage | ANR Trailing 12M P/E 27.80 Prior Announcement Buy/Hold/Sell 27/9/2 11/17/20 Forward 12M P/E 26.74 Current Price 149.37 Avg/Implied 1 Day Move 3.30% / 4.33% Est. LTG (EPS) 6.10% Target Price 159.47 4) Consensus Overview | EEO >> 20) Current Period Overview (Yr/21) 22) Prior Period Analysis (Vr/20) Measure Yr/21 Est 4Wk Chg YOY Gr Growth vs Comps Past Surprise 10 EPS, Adj. 5.585 4.89% 13.1% In-line Beat 6 of 8 12 EPS, GAAP 6.450 8.65% 24.3% Stronger Missed 5 of 8 13) Revenue 554.671B 0.81% 5.9% Weaker Missed 5 of 8 14 Net Income, Adj+ 15.942B 5.50% 12.2% In-line Beat 5 of 8 15) Operating Profit 23.600B 3.67% 16) EBITDA 34.855B 2.61% 7.4% In-line Missed 6 of 8 5) Earnings Trends | EM >> 6 Bloomberg Intelligence Review | BI >> 7) Earnings Estimates Graph EEG >> Guidance EPS, A 7.00 Walmart Momentum May Hold with Solid 200W 210, Antimate 5.59 Estimates. Ad -0.00 Price 340.37 Holiday: Earnings Outlook Actual PS, AL 5.00 Post-3Q Earnings Outlook: Walmart is 140 4.00 improving its in-stock position and 3.00 anticipates a strong fiscal 49 sales 2.00 season as consumers seek some 1.00 normalcy in holiday celebrations. Gross margin has trended higher in recent 2030 2020 100 5.40 5.20 100 5.00 2010 2030 203 2024 DVD Track dividends, splits & distributions Suggested Functions CN Read the latest news on a company PENG 920 AM 11/18/2020 EN O Type here to search ORA DOLL 3. (10 points) Find one or two Wall Street Journal articles on a stock that had an initial public offering (IPO) in 2020 and provide a summary of the article(s) including how the stock has performed since the IPO. Make sure you include the web link of the WSJ article(s) you used to answer this question. Note that all Brooklyn College students can register to have a free WSJ subscription as explained in the syllabus. Answer: 1 The weblink for the WSJ articles used to answer this question: TARGET CORP Equity - EE - Related Functions Menu Message * C.? Screen Printed Put Bloomberg's Earnings Tools to Work | New Videos X TGT US Equity Alert Target Corp Periodicity Annuals Source BEst Mean Consensus (Standard) Cur USD Earnings & Estimates 1 Earnings History | ERN Consensus Overview | EEO >> Next Announcement 3) Analyst Coverage | ANR TBA Trailing 12M P/E 19.38 Prior Announcement Buy/Hold/Sell 20/8/2 11/18/20 Forward 12M P/E 22.02 4.61% / 5.97% Current Price Avg/Implied 1 Day Move 163.04 Est. LTG (EPS) 8.72% Target Price 167.12 4) Consensus Overview | EEO >> 21) Current Period Overview (Yr/21) 22 Prior Period Analysis (Yr/20) Measure Yr/21 Est 4Wk Chg YOY Gr Growth vs Comps Past Surprise 11 EPS, Adj+ 7.403 2.05% 15.6% In-line Missed 5 of 8 12 EPS, GAAP 7.418 2.20% 17.0% Weaker Beat 4 of 8 13) Revenue 87.574B 0.29% 14.18 Stronger Beat 4 of 8 14) Net Income, Adj+ 3.704B 1.98% 12.4% In-line Beat 5 of 8 15) Operating Profit 5.178B 1.58% 16) EBITDA 7.723B 1.32% 5.7% Weaker Beat 5 of 8 5) Earnings Trends | EM >> 6 Earnings Estimates Graph | EEG >> Guidance EPS, AG) W 21 EPS, Ady Estiu 1.40 16.01 Estimate EPS, Ad 7.50 Actual UPS, A 700 140 6.00 ED 3.00 500 0.00 220 200 Pro 7.00 6.00 1.00 2019 2002 2018 2020 MODL Get analyst models & deep estimates Suggested Functions BRC Research Portal: Single Security ENG 9:18 AM 11/18/2020 E Type here to search DOLL Delete End Calc F11 F12 Home F10 FO WALMART INC Equity - | EE - Related Functions Menu Message ? Click values in the grid for more information Put Bloomberg's Earnings Tools to Work | New Videos WMT US Equity Alert Earnings & Estimates Walmart Inc Periodicity Annuals Source BEst Mean Consensus (Standard) Cur USD 1 Earnings History | ERN 2) Consensus Overview | EEO Next Announcement (C) 02/18/21 3) Analyst Coverage | ANR Trailing 12M P/E 27.80 Prior Announcement Buy/Hold/Sell 27/9/2 11/17/20 Forward 12M P/E 26.74 Current Price 149.37 Avg/Implied 1 Day Move 3.30% / 4.33% Est. LTG (EPS) 6.10% Target Price 159.47 4) Consensus Overview | EEO >> 20) Current Period Overview (Yr/21) 22) Prior Period Analysis (Vr/20) Measure Yr/21 Est 4Wk Chg YOY Gr Growth vs Comps Past Surprise 10 EPS, Adj. 5.585 4.89% 13.1% In-line Beat 6 of 8 12 EPS, GAAP 6.450 8.65% 24.3% Stronger Missed 5 of 8 13) Revenue 554.671B 0.81% 5.9% Weaker Missed 5 of 8 14 Net Income, Adj+ 15.942B 5.50% 12.2% In-line Beat 5 of 8 15) Operating Profit 23.600B 3.67% 16) EBITDA 34.855B 2.61% 7.4% In-line Missed 6 of 8 5) Earnings Trends | EM >> 6 Bloomberg Intelligence Review | BI >> 7) Earnings Estimates Graph EEG >> Guidance EPS, A 7.00 Walmart Momentum May Hold with Solid 200W 210, Antimate 5.59 Estimates. Ad -0.00 Price 340.37 Holiday: Earnings Outlook Actual PS, AL 5.00 Post-3Q Earnings Outlook: Walmart is 140 4.00 improving its in-stock position and 3.00 anticipates a strong fiscal 49 sales 2.00 season as consumers seek some 1.00 normalcy in holiday celebrations. Gross margin has trended higher in recent 2030 2020 100 5.40 5.20 100 5.00 2010 2030 203 2024 DVD Track dividends, splits & distributions Suggested Functions CN Read the latest news on a company PENG 920 AM 11/18/2020 EN O Type here to search ORA DOLL 3. (10 points) Find one or two Wall Street Journal articles on a stock that had an initial public offering (IPO) in 2020 and provide a summary of the article(s) including how the stock has performed since the IPO. Make sure you include the web link of the WSJ article(s) you used to answer this question. Note that all Brooklyn College students can register to have a free WSJ subscription as explained in the syllabus. Answer: 1 The weblink for the WSJ articles used to answer this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts