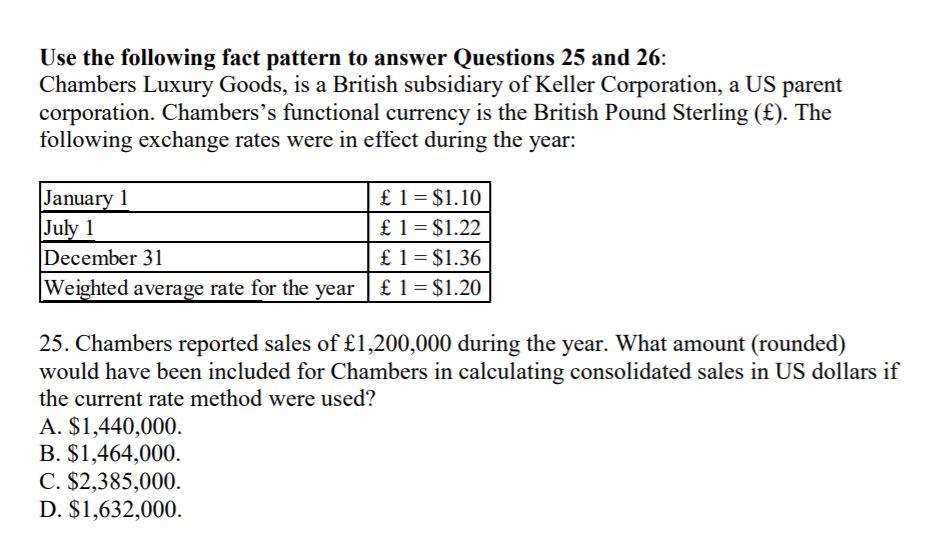

Question: Use the following fact pattern to answer Questions 25 and 26: Chambers Luxury Goods, is a British subsidiary of Keller Corporation, a US parent corporation.

Use the following fact pattern to answer Questions 25 and 26: Chambers Luxury Goods, is a British subsidiary of Keller Corporation, a US parent corporation. Chambers's functional currency is the British Pound Sterling (). The following exchange rates were in effect during the year: January 1 July 1 December 31 Weighted average rate for the year 1=$1.10 1=$1.22 1 = $1.36 1 = $1.20 25. Chambers reported sales of 1,200,000 during the year. What amount (rounded) would have been included for Chambers in calculating consolidated sales in US dollars if the current rate method were used? A. $1,440,000. B. $1,464,000. C. $2,385,000. D. $1,632,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts