Question: You are thinking about opening a car dealership. You bought some real estate last year for $700,000 which you will use for the dealership. The

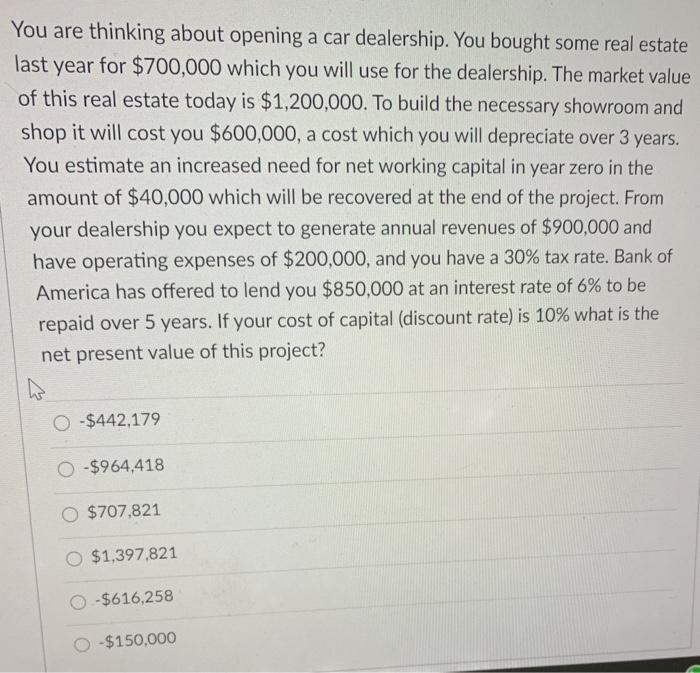

You are thinking about opening a car dealership. You bought some real estate last year for $700,000 which you will use for the dealership. The market value of this real estate today is $1,200,000. To build the necessary showroom and shop it will cost you $600,000, a cost which you will depreciate over 3 years. You estimate an increased need for net working capital in year zero in the amount of $40,000 which will be recovered at the end of the project. From your dealership you expect to generate annual revenues of $900,000 and have operating expenses of $200,000, and you have a 30% tax rate. Bank of America has offered to lend you $850,000 at an interest rate of 6% to be repaid over 5 years. If your cost of capital (discount rate) is 10% what is the net present value of this project? -$442,179 O-$964,418 O $707,821 $1,397.821 -$616,258 -$150,000 You are thinking about opening a car dealership. You bought some real estate last year for $700,000 which you will use for the dealership. The market value of this real estate today is $1,200,000. To build the necessary showroom and shop it will cost you $600,000, a cost which you will depreciate over 3 years. You estimate an increased need for net working capital in year zero in the amount of $40,000 which will be recovered at the end of the project. From your dealership you expect to generate annual revenues of $900,000 and have operating expenses of $200,000, and you have a 30% tax rate. Bank of America has offered to lend you $850,000 at an interest rate of 6% to be repaid over 5 years. If your cost of capital (discount rate) is 10% what is the net present value of this project? -$442,179 O-$964,418 O $707,821 $1,397.821 -$616,258 -$150,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts