Question: Your Tasks Task 1 Pioneer Steels Ltd. is considering two mutually exclusive projects. Both require an initial cash outlay of 10,000 each and have a

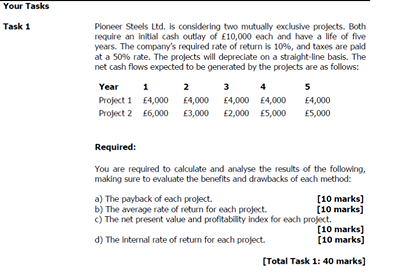

Your Tasks Task 1 Pioneer Steels Ltd. is considering two mutually exclusive projects. Both require an initial cash outlay of 10,000 each and have a life of five years. The company's required rate of return is 10%, and taxes are paid at a 50% rate. The projects will depreciate on a straight-line basis. The net cash flows expected to be generated by the projects are as follows: Year 1 2 3 4 5 Project 1 4,000 4,000 4,000 4,000 4,000 Project 2 6,000 3,000 2,000 5,000 5,000 Required: You are required to calculate and analyse the results of the following, making sure to evaluate the benefits and drawbacks of each method: a) The payback of each project. (10 marks) b) The average rate of return for each project. (10 marks) c) The net present value and profitability index for each project. (10 marks] d) The internal rate of return for each project. (10 marks) [Total Task 1: 40 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts