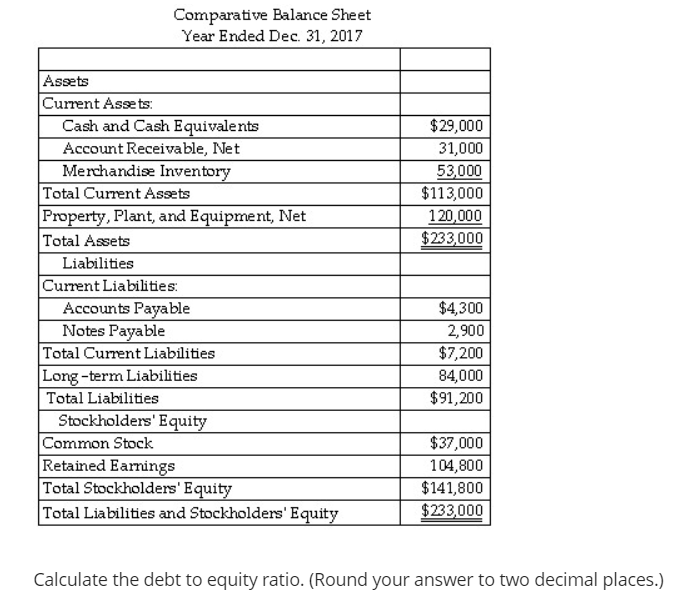

Question: TranscribedText: Comparative Balance Sheet Year Ended Dec. 3], 101? Assets Current Assets: Cash and Cash Equivalents Account Receivable, Net Merchandise Inventory Total Current Assets Property,

TranscribedText: Comparative Balance Sheet Year Ended Dec. 3"], 101? Assets Current Assets: Cash and Cash Equivalents Account Receivable, Net Merchandise Inventory Total Current Assets Property, Plant, and Equipment, Net Total Assets Liabililies Current Liabilities: Accounts Pa able Notes Payable Total Current Liabilities Long term Liabilies Total Liabililies Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities and Shockhnlders' Equity w 69 .433 D a D E III D 69 II ._s w 0 C III l w 0 D D a B H? w a w u up a: on who D 1:: DD 1: n "D Calculate the debt to equity ratio. [Round your answer to two decimal places.)

Assets Current Assets: Comparative Balance Sheet Year Ended Dec. 31, 2017 Cash and Cash Equivalents $29,000 Account Receivable, Net 31,000 Merchandise Inventory 53,000 Total Current Assets $113,000 Property, Plant, and Equipment, Net 120,000 Total Assets $233,000 Liabilities Current Liabilities: Accounts Payable Notes Payable Total Current Liabilities Long-term Liabilities Total Liabilities Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity $4,300 2,900 $7,200 84,000 $91,200 $37,000 104,800 $141,800 $233,000 Calculate the debt to equity ratio. (Round your answer to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts