Question: Transfer pricing ( 2 0 2 3 ) HighTech Inc. ' s Screen Division manufactures AMOLED display screens used in mobile devices and televisions. Part

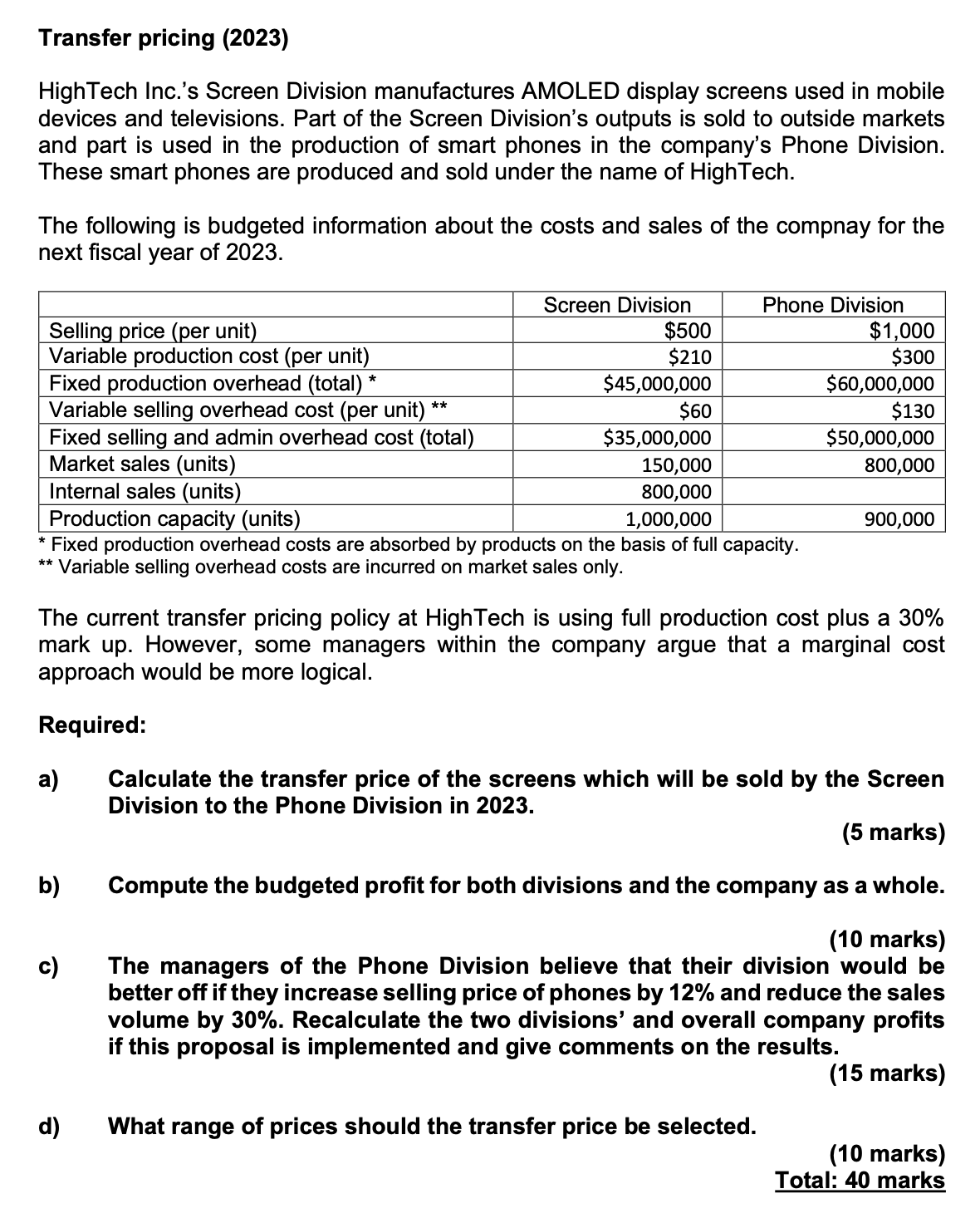

Transfer pricing HighTech Inc.s Screen Division manufactures AMOLED display screens used in mobile devices and televisions. Part of the Screen Division's outputs is sold to outside markets and part is used in the production of smart phones in the company's Phone Division. These smart phones are produced and sold under the name of HighTech. The following is budgeted information about the costs and sales of the compnay for the next fiscal year of Fixed production overhead costs are absorbed by products on the basis of full capacity. Variable selling overhead costs are incurred on market sales only. The current transfer pricing policy at HighTech is using full production cost plus a mark up However, some managers within the company argue that a marginal cost approach would be more logical Required: a Calculate the transfer price of the screens which will be sold by the Screen Division to the Phone Division in marks b Compute the budgeted profit for both divisions and the company as a whole. marks c The managers of the Phone Division believe that their division would be better off if they increase selling price of phones by and reduce the sales volume by mathbf Recalculate the two divisions' and overall company profits if this proposal is implemented and give comments on the results. marks d What range of prices should the transfer price be selected. marks Total: marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock