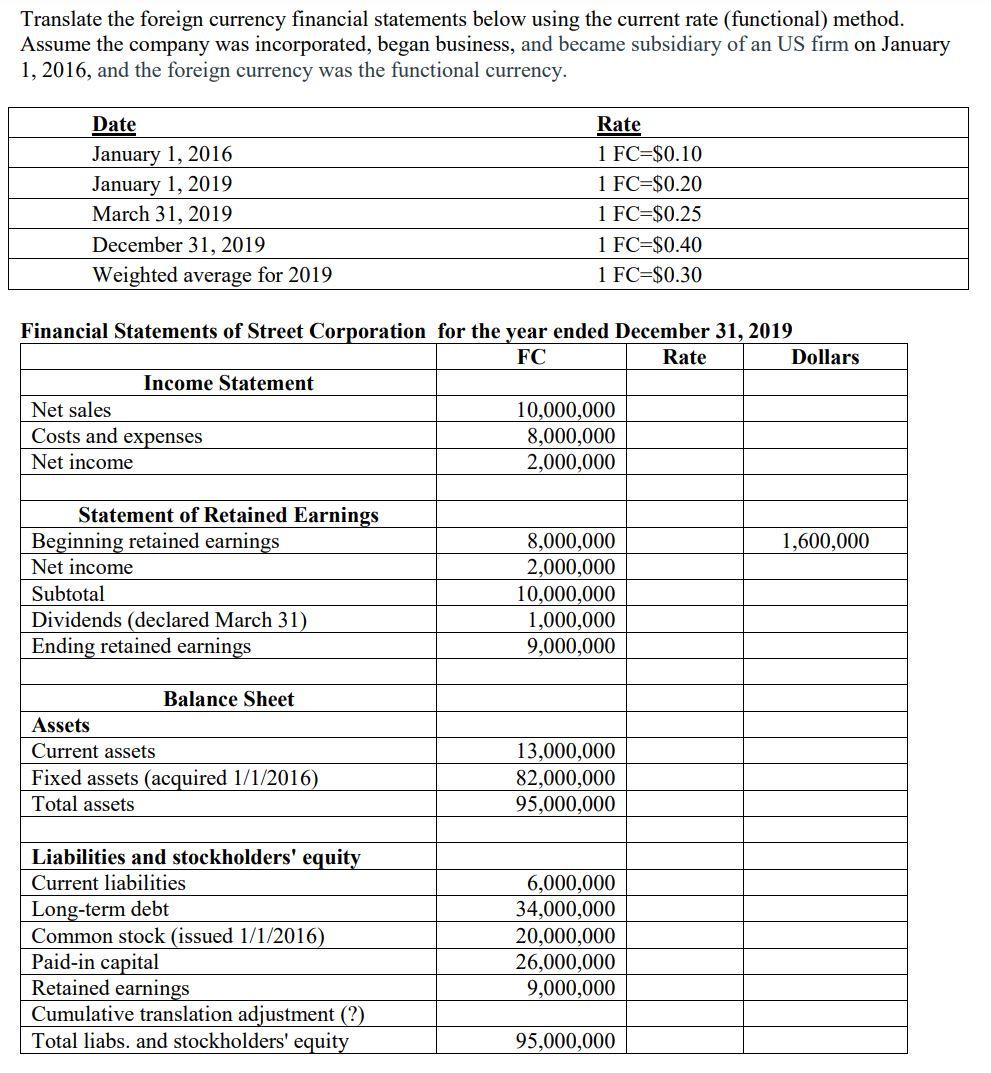

Question: Translate the foreign currency financial statements below using the current rate (functional) method. Assume the company was incorporated, began business, and became subsidiary of

Translate the foreign currency financial statements below using the current rate (functional) method. Assume the company was incorporated, began business, and became subsidiary of an US firm on January 1, 2016, and the foreign currency was the functional currency. Date January 1, 2016 January 1, 2019 Rate 1 FC=$0.10 1 FC=$0.20 March 31, 2019 December 31, 2019 Weighted average for 2019 1 FC=$0.25 1 FC=$0.40 1 FC=$0.30 Financial Statements of Street Corporation for the year ended December 31, 2019 FC Rate Dollars Income Statement Net sales 10,000,000 Costs and expenses 8,000,000 Net income 2,000,000 Statement of Retained Earnings Beginning retained earnings 8,000,000 1,600,000 Net income 2,000,000 Subtotal 10,000,000 Dividends (declared March 31) 1,000,000 Ending retained earnings 9,000,000 Balance Sheet Assets Current assets 13,000,000 Fixed assets (acquired 1/1/2016) 82,000,000 Total assets 95,000,000 Liabilities and stockholders' equity Current liabilities 6,000,000 Long-term debt 34,000,000 Common stock (issued 1/1/2016) 20,000,000 Paid-in capital 26,000,000 Retained earnings 9,000,000 Cumulative translation adjustment (?) Total liabs. and stockholders' equity 95,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts