Question: Treadway Moving Service specializesin transferring sensitive electronic in-struments. The prospect of some new 3-D dual-material prototypingmachines exists but the trailer set-up is just over $125,000

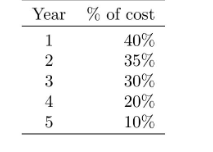

Treadway Moving Service specializesin transferring sensitive electronic in-struments. The prospect of some new 3-D dual-material prototypingmachines exists but the trailer set-up is just over $125,000 to pur-chase. The investment is still appeal-ing since Boston Consulting Groupsurveys show that the business canexpect to grow for at least another 10years. Treadways marginal tax rateis 40% and they have a fairly goodcredit rating so they obtain a loan fortwo trailers at a 10% interest rate fora 60-month loan. The depreciationschedule for the trailer is shown be-low. Leasing is popular, and it turnsout the dealer will lease to Treadway.The annual payment for two trail-ers was quoted at $45,000, and af-ter some debate the purchase optionat lease-end was set at 1/5 of cost($25,000 for each trailer). If Tread-way has to absorb all taxes, mainte-nance, and insurance, is leasing thebest option for Treadway?

\begin{tabular}{cr} Year & % of cost \\ \hline 1 & 40% \\ 2 & 35% \\ 3 & 30% \\ 4 & 20% \\ 5 & 10% \\ \hline \end{tabular} \begin{tabular}{cr} Year & % of cost \\ \hline 1 & 40% \\ 2 & 35% \\ 3 & 30% \\ 4 & 20% \\ 5 & 10% \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts