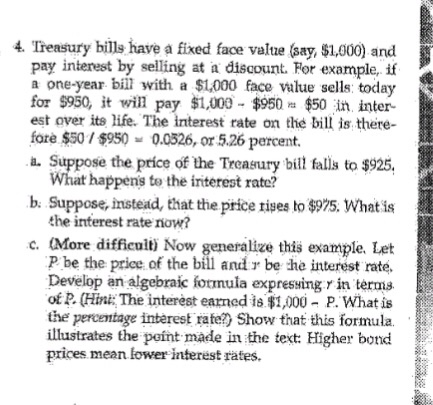

Question: Treasury bilb have a fixed face value (say, $1,000) and pay interest by celling at a discount. For example, If a one-year bill with a

Treasury bilb have a fixed face value (say, $1,000) and pay interest by celling at a discount. For example, If a one-year bill with a $1,000 face virtue sells today for $950, it will pay $1,000 - $950 s $50 in interest over its life. The interest rate on the bill la therefore $50/$950 " 0.0526, or 5.26 percent. Suppose the price of the Trcamiry bill fate to $925. What happens U> the interest rate? Suppose, instead, that the price rises to $9/'5. What is the interest rate now? (More difficult) Now generalize this example. Let P be the price of the bill and r be die interest rate. Develop an algebraic formula expressing r in term* of P. (The interest earned io $1,000 - P. What is the' percentage interest rate?) Show that this formula illustrates the point made in the text: Higher bond prices mean lower interest rates. Treasury bilb have a fixed face value (say, $1,000) and pay interest by celling at a discount. For example, If a one-year bill with a $1,000 face virtue sells today for $950, it will pay $1,000 - $950 s $50 in interest over its life. The interest rate on the bill la therefore $50/$950 " 0.0526, or 5.26 percent. Suppose the price of the Trcamiry bill fate to $925. What happens U> the interest rate? Suppose, instead, that the price rises to $9/'5. What is the interest rate now? (More difficult) Now generalize this example. Let P be the price of the bill and r be die interest rate. Develop an algebraic formula expressing r in term* of P. (The interest earned io $1,000 - P. What is the' percentage interest rate?) Show that this formula illustrates the point made in the text: Higher bond prices mean lower interest rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts