Question: Treasury Stock and Stock Splits - Additional Quest 1. ABC Company re-acquired 500 shares of outstanding shares for OMR 2 each on 10th October 2019.

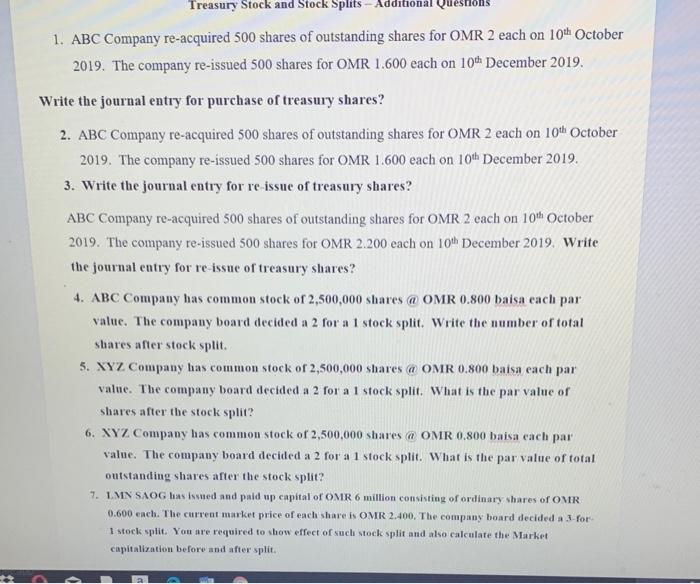

Treasury Stock and Stock Splits - Additional Quest 1. ABC Company re-acquired 500 shares of outstanding shares for OMR 2 each on 10th October 2019. The company re-issued 500 shares for OMR 1.600 each on 104 December 2019. Write the journal entry for purchase of treasury shares? 2. ABC Company re-acquired 500 shares of outstanding shares for OMR 2 each on 10th October 2019. The company re-issued 500 shares for OMR 1.600 each on 10th December 2019. 3. Write the journal entry for re-issue of treasury shares? ABC Company re-acquired 500 shares of outstanding shares for OMR 2 each on 10th October 2019. The company re-issued 500 shares for OMR 2.200 each on 10th December 2019. Write the journal entry for re issue of treasury shares? 4. ABC Company has common stock of 2,500,000 shares @ OMR 0.800 baisa each par value. The company board decided a 2 for a 1 stock split. Write the number of total shares after stock split. 5. XYZ Company has common stock of 2,500,000 shares a OMR 0.800 baisa each par value. The company board decided a 2 for a 1 stock split. What is the par value of shares after the stock split? 6. XYZ Company has common stock of 2,500,000 shares a OMR 0,800 baisa each par value. The company board decided a 2 for a I stock split. What is the par value of total outstanding shares after the stock split? 7. LMN SAOG has issued and paid up capital of OMR 6 million consisting of ordinary shares of OMR 0.600 each. The current market price of each share is OMR 2.400. The company board decided a 3 for 1 stock split. You are required to show effect of such stock split and also calculate the Market capitalization before and after split

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts