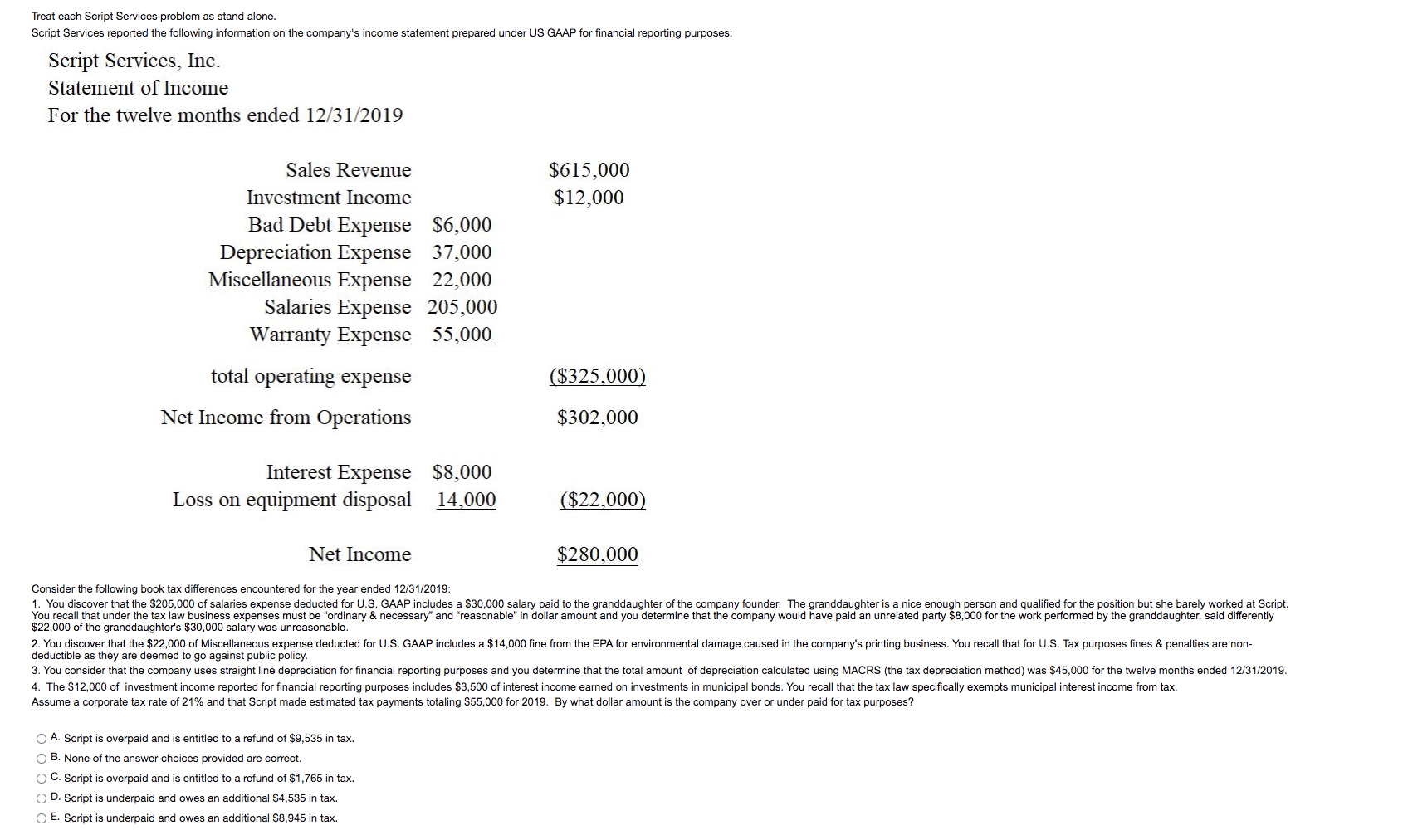

Question: Treat each Script Services problem as stand alone. Script Services reported the following information on the company's income statement prepared under US GAAP for financial

Treat each Script Services problem as stand alone. Script Services reported the following information on the company's income statement prepared under US GAAP for financial reporting purposes: Script Services, Inc. Statement of Income For the twelve months ended 12/31/2019 $615.000 $12,000 Sales Revenue Investment Income Bad Debt Expense $6,000 Depreciation Expense 37,000 Miscellaneous Expense 22,000 Salaries Expense 205,000 Warranty Expense 55,000 ($325,000) total operating expense Net Income from Operations $302.000 Interest Expense $8,000 Loss on equipment disposal 14,000 ($22,000) Net Income $280,000 Consider the following book tax differences encountered for the year ended 12/31/2019: 1. You discover that the $205,000 of salaries expense deducted for U.S. GAAP includes a $30,000 salary paid to the granddaughter of the company founder. The granddaughter is a nice enough person and qualified for the position but she barely worked at Script. You recall that under the tax law business expenses must be "ordinary & necessary" and "reasonable" in dollar amount and you determine that the company would have paid an unrelated party $8,000 for the work performed by the granddaughter, said differently $22,000 of the granddaughter's $30,000 salary was unreasonable. 2. You discover that the $22,000 of Miscellaneous expense deducted for U.S. GAAP includes a $14,000 fine from the EPA for environmental damage caused in the company's printing business. You recall that for U.S. Tax purposes fines & penalties are non- deductible as they are deemed to go against public policy. 3. You consider that the company uses straight line depreciation for financial reporting purposes and you determine that the total amount of depreciation calculated using MACRS (the tax depreciation method) was $45,000 for the twelve months ended 12/31/2019. 4. The $12,000 of investment income reported for financial reporting purposes includes $3,500 of interest income earned on investments in municipal bonds. You recall that the tax law specifically exempts municipal interest income from tax. Assume a corporate tax rate of 21% and that Script made estimated tax payments totaling $55,000 for 2019. By what dollar amount is the company over or under paid for tax purposes? A. Script is overpaid and is entitled to a refund of $9,535 in tax. OB. None of the answer choices provided are correct. OC. Script is overpaid and is entitled to a refund of $1,765 in tax. OD. Script is underpaid and owes an additional $4,535 in tax. E. Script is underpaid and owes an additional $8,945 in tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts