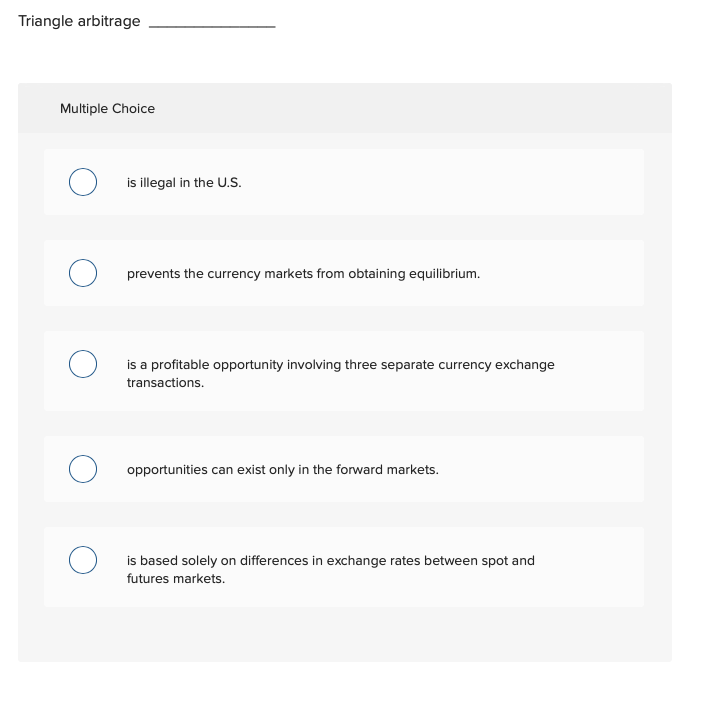

Question: Triangle arbitrage Multiple Choice is illegal in the U.S. prevents the currency markets from obtaining equilibrium. is a profitable opportunity involving three separate currency exchange

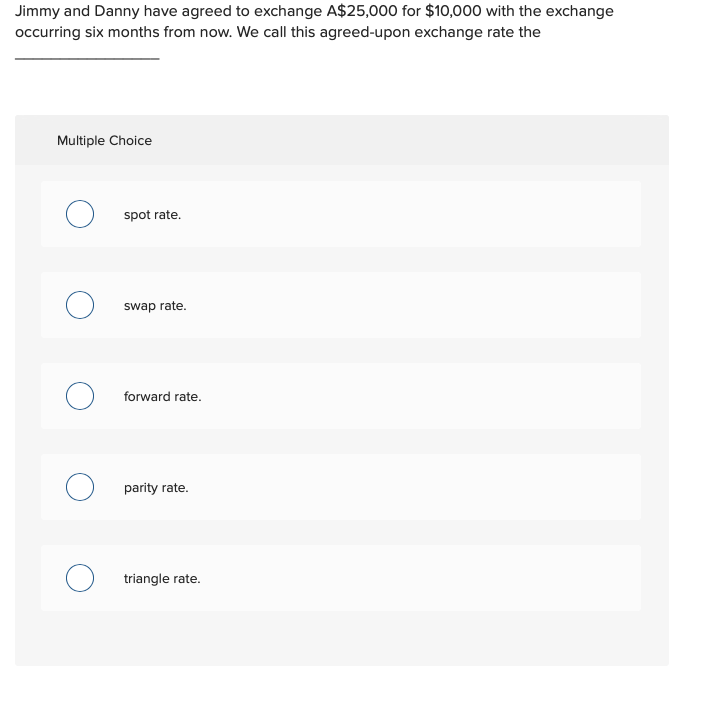

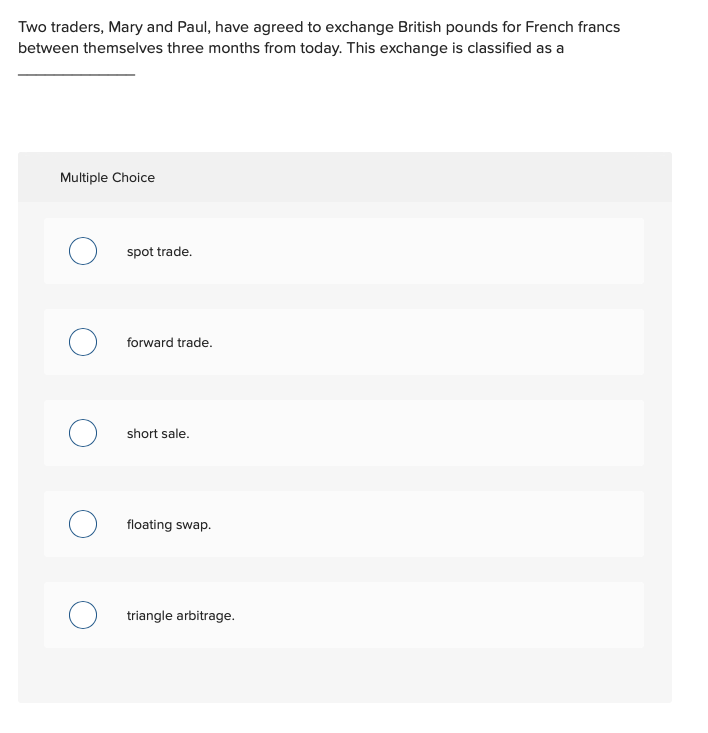

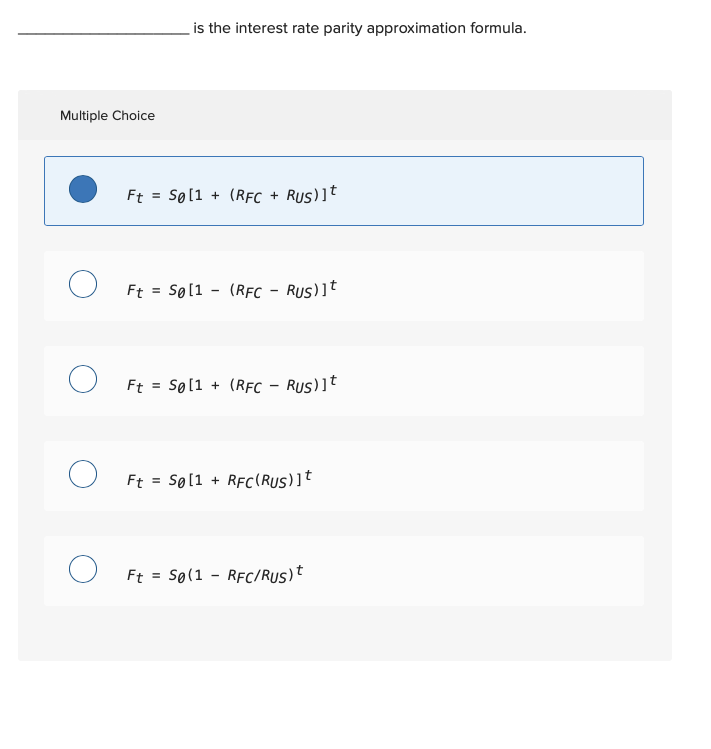

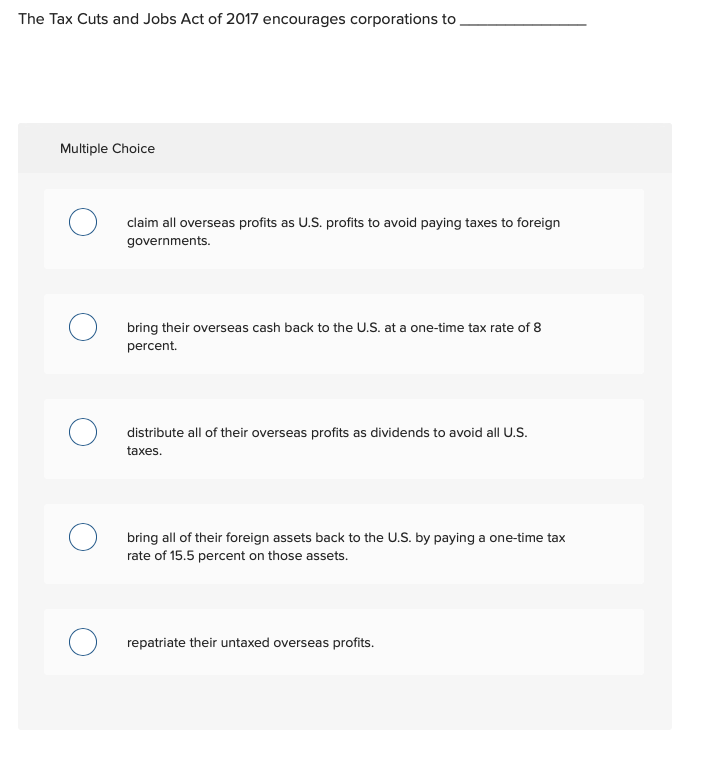

Triangle arbitrage Multiple Choice is illegal in the U.S. prevents the currency markets from obtaining equilibrium. is a profitable opportunity involving three separate currency exchange transactions. opportunities can exist only in the forward markets. o oo is based solely on differences in exchange rates between spot and futures markets. Jimmy and Danny have agreed to exchange A$25,000 for $10,000 with the exchange occurring six months from now. We call this agreed-upon exchange rate the Multiple Choice spot rate. swap rate. forward rate. parity rate. triangle rate. Two traders, Mary and Paul, have agreed to exchange British pounds for French francs between themselves three months from today. This exchange is classified as a Multiple Choice O spot trade. O forward trade. O short sale. O floating swap. O triangle arbitrage. is the interest rate parity approximation formula. Multiple Choice Ft = S@[1 + (RFC + RUS)]t 0 Ft = S [1 - (RFC - Rus)]t Ft = S[1 + (RFC - Rust Ft = SQ[1 + RFC(RUS)]t 0 Ft = s(1 - RFC/Rus) Triangle arbitrage Multiple Choice is illegal in the U.S. prevents the currency markets from obtaining equilibrium. is a profitable opportunity involving three separate currency exchange transactions. opportunities can exist only in the forward markets. o oo is based solely on differences in exchange rates between spot and futures markets. Jimmy and Danny have agreed to exchange A$25,000 for $10,000 with the exchange occurring six months from now. We call this agreed-upon exchange rate the Multiple Choice spot rate. swap rate. forward rate. parity rate. triangle rate. Two traders, Mary and Paul, have agreed to exchange British pounds for French francs between themselves three months from today. This exchange is classified as a Multiple Choice O spot trade. O forward trade. O short sale. O floating swap. O triangle arbitrage. is the interest rate parity approximation formula. Multiple Choice Ft = S@[1 + (RFC + RUS)]t 0 Ft = S [1 - (RFC - Rus)]t Ft = S[1 + (RFC - Rust Ft = SQ[1 + RFC(RUS)]t 0 Ft = s(1 - RFC/Rus)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts