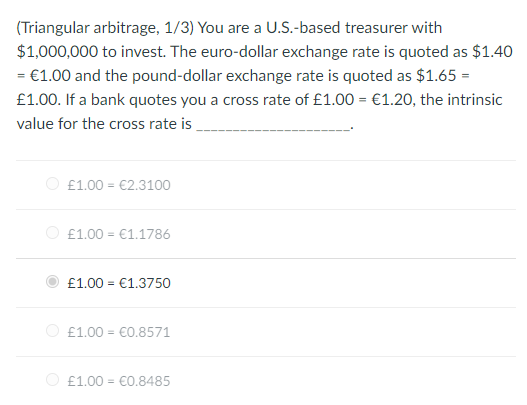

Question: (Triangular arbitrage, 1/3) You are a U.S.-based treasurer with $1,000,000 to invest. The euro-dollar exchange rate is quoted as $1.40 = 1.00 and the pound-dollar

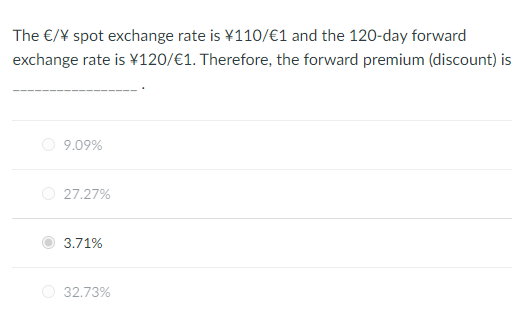

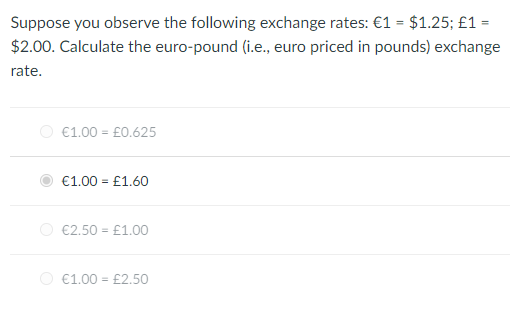

(Triangular arbitrage, 1/3) You are a U.S.-based treasurer with $1,000,000 to invest. The euro-dollar exchange rate is quoted as $1.40 = 1.00 and the pound-dollar exchange rate is quoted as $1.65 = 1.00. If a bank quotes you a cross rate of 1.00 = 1.20, the intrinsic value for the cross rate is 1.00 = 2.3100 1.00 = 1.1786 1.00 = 1.3750 1.00 = 0.8571 1,00 = 0.8485 The / spot exchange rate is 110/1 and the 120-day forward exchange rate is 120/1. Therefore, the forward premium (discount) is 9.09% 27.27% 3.71% 32.73% Suppose you observe the following exchange rates: 1 = $1.25; 1 = $2.00. Calculate the euro-pound (i.e., euro priced in pounds) exchange rate. 1.00 = 0.625 1.00 = 1.60 2.50 = 1.00 1.00 = 2.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts