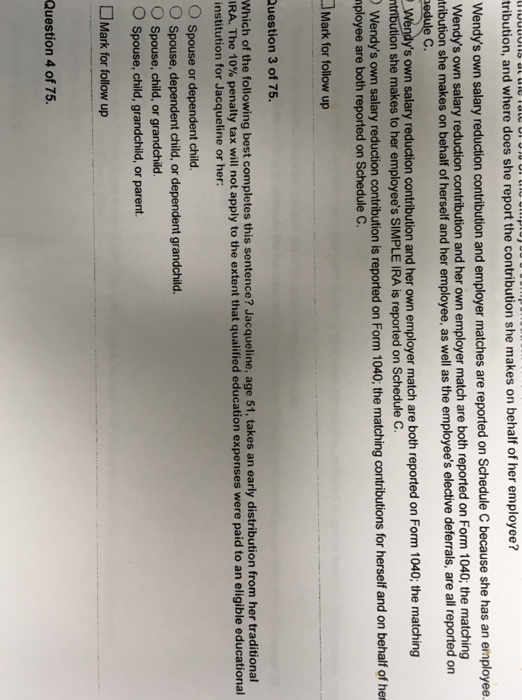

Question: tribution, and where does she report the contribution she makes on behalf of her employee? Wendy's own salary reduction contribution and employer matches are reported

tribution, and where does she report the contribution she makes on behalf of her employee? Wendy's own salary reduction contribution and employer matches are reported on Schedule C because she has an employee. Wendy's own salary reduction contribution and her own employer match are both reported on Form 1040: the matching tribution she makes on behalf of herself and her employee, as well as the employee's elective deferrals, are all reported on ys own salary reduction contribution and her own employer match are both reported on Form 1040; the matching Wendy ntribution she makes to her employee's SIMPLE IRA is reported on Schedule C Wendy's own salary reduction contribution is reported on Form 1040, the matching contributions for herself and on behalf of he ployee are both reported on Schedule C. Mark for follow up Question 3 of 75 Which of the following best completes this sentence? Jacqueline, age 51, takes an early distribution from her traditional IRA. The 10% penalty tax will not apply to the extent that qualified education expenses were paid to an eligible educational institution for Jacqueline or her: O Spouse or dependent child O Spouse, dependent child, or dependent grandchild. O Spouse, child, or grandchild O Spouse, child, grandchild, or parent. Mark for follow up Question 4 of 75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts